This article only has some code , There are many contents to be analyzed , But there is no necessary explanation

It's my first time to do , I don't know much about stocks , There may be some mistakes .

# Guide pack

import numpy as np

import matplotlib.pyplot as plt

from pandas_datareader import data

from scipy.signal import find_peaks

from scipy.stats import norm

import pandas_datareader.data as web

import pandas_datareader.data as webdata

import datetime

import pandas as pd

import seaborn as sns # pip install seaborn

import matplotlib.patches as mpatches

from pyfinance import TSeries # pip install pyfinance

from empyrical import sharpe_ratio,omega_ratio,alpha_beta,stats # pip install empyrical

import warnings

warnings.filterwarnings('ignore')

tickers = ['F','TSLA','FSR','GM','NEE','SO','BYD','NIO','SOL','JKS']

startDate = '2019-06-01'

endDate = '2022-06-01'

F = webdata.get_data_stooq('F',startDate,endDate) # ford

TSLA = webdata.get_data_stooq('TSLA',startDate,endDate) # tesla

FSR = webdata.get_data_stooq('FSR',startDate,endDate) # Duke energy

GM = webdata.get_data_stooq('GM',startDate,endDate) # general motors

NEE = webdata.get_data_stooq('NEE',startDate,endDate) # NextEra Energy companies

SO = webdata.get_data_stooq('SO',startDate,endDate)# Southern Company

BYD = webdata.get_data_stooq('BYD',startDate,endDate)# BYD

NIO = webdata.get_data_stooq('NIO',startDate,endDate) # Wei to

SOL = webdata.get_data_stooq('SOL',startDate,endDate) # Renewables new energy

JKS = webdata.get_data_stooq('JKS',startDate,endDate) # Faraday's future

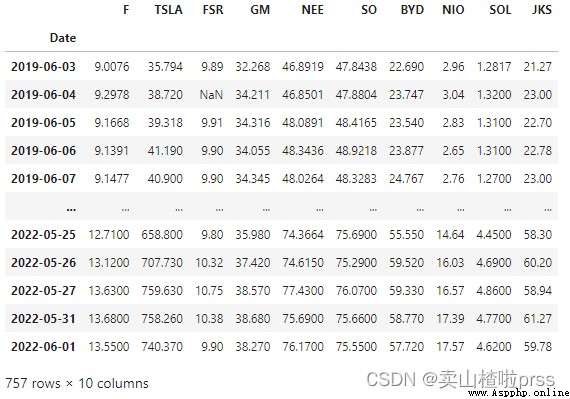

stocks = pd.DataFrame({

"F": F["Close"],

"TSLA": TSLA["Close"],

"FSR": FSR["Close"],

"GM": GM["Close"],

"NEE": NEE["Close"],

"SO": SO["Close"],

"BYD": BYD["Close"],

"NIO": NIO["Close"],

"SOL": SOL["Close"],

"JKS": JKS["Close"],

})

stocks

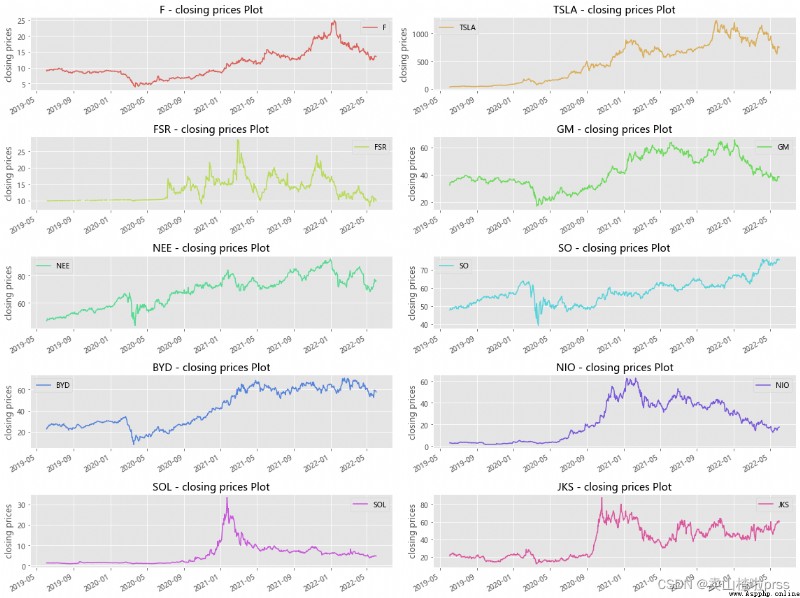

Plot the closing prices of the stocks

# Closing price trend

plt.style.use('ggplot') # style

color_palette=sns.color_palette("hls",10) # Color

plt.rcParams['font.sans-serif']=['Microsoft YaHei']

fig = plt.figure(figsize = (16,12))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

stocks[j].plot(kind='line', style=['-'],color=color_palette[i],label=j)

plt.xlabel('')

plt.ylabel('closing prices')

plt.title('{} - closing prices Plot'.format(j))

plt.legend()

plt.tight_layout()

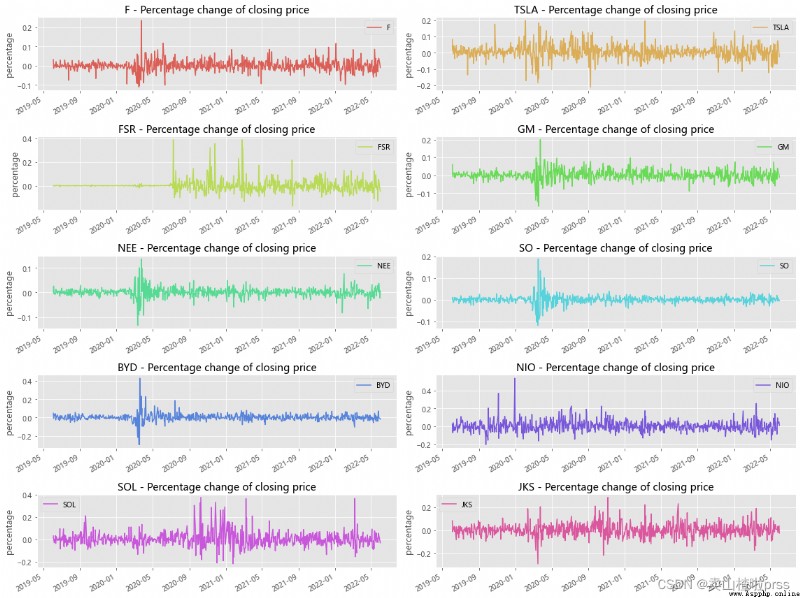

Percentage change of closing price(day)

# Daily yield trend

# As you can see from the picture above , The overall fluctuation trend is up and down , Individual time points have great volatility .

plt.style.use('ggplot')

color_palette=sns.color_palette("hls",10)

plt.rcParams['font.sans-serif']=['Microsoft YaHei']

fig = plt.figure(figsize = (16,12))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

stocks[j].pct_change().plot(kind='line', style=['-'],color=color_palette[i],label=j)

plt.xlabel('')

plt.ylabel('percentage')

plt.title('{} - Percentage change of closing price'.format(j))

plt.legend()

plt.tight_layout()

Average daily return of closing price

# Average daily earnings

for i in tickers:

r_daily_mean = ((1+stocks[i].pct_change()).prod())**(1/stocks[i].shape[0])-1

#print("%s - Average daily return:%f"%(i,r_daily_mean))

print("%s - Average daily return is:%s"%(i,str(round(r_daily_mean*100,2))+"%"))

F - Average daily return is:0.05%

TSLA - Average daily return is:0.4%

FSR - Average daily return is:0.0%

GM - Average daily return is:0.02%

NEE - Average daily return is:0.06%

SO - Average daily return is:0.06%

BYD - Average daily return is:0.12%

NIO - Average daily return is:0.24%

SOL - Average daily return is:0.17%

JKS - Average daily return is:0.14%

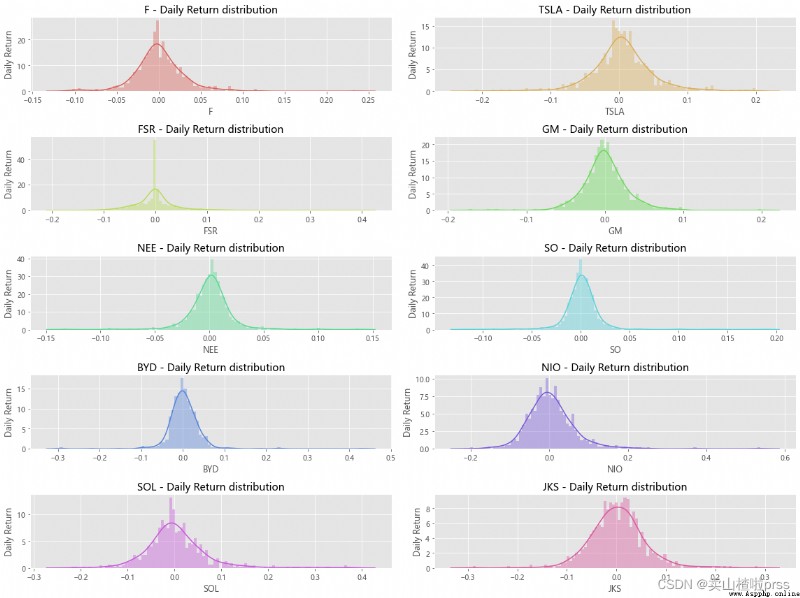

# Probability distribution diagram of daily yield

# Look at the distribution

plt.style.use('ggplot')

plt.rcParams['font.sans-serif']=['Microsoft YaHei']

fig = plt.figure(figsize = (16,12))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

sns.distplot(stocks[j].pct_change(), bins=100, color=color_palette[i])

plt.ylabel('Daily Return')

plt.title('{} - Daily Return distribution'.format(j))

plt.tight_layout();

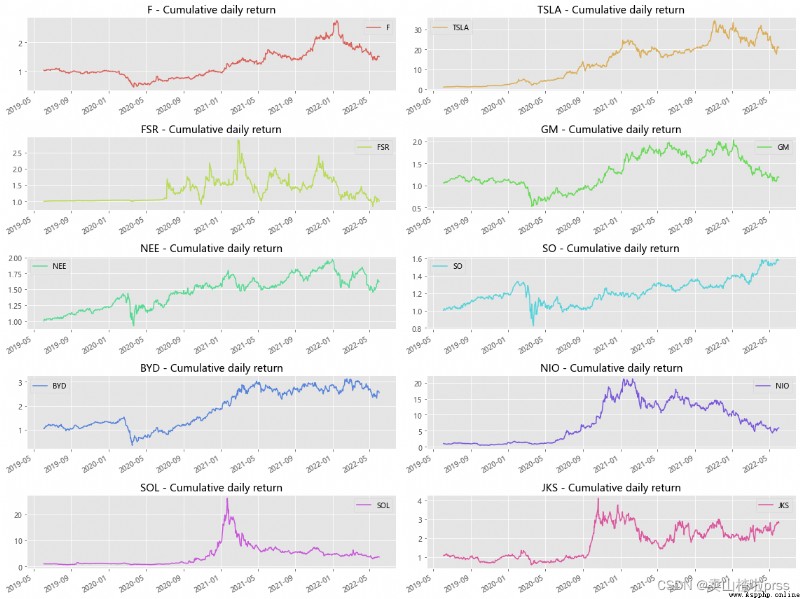

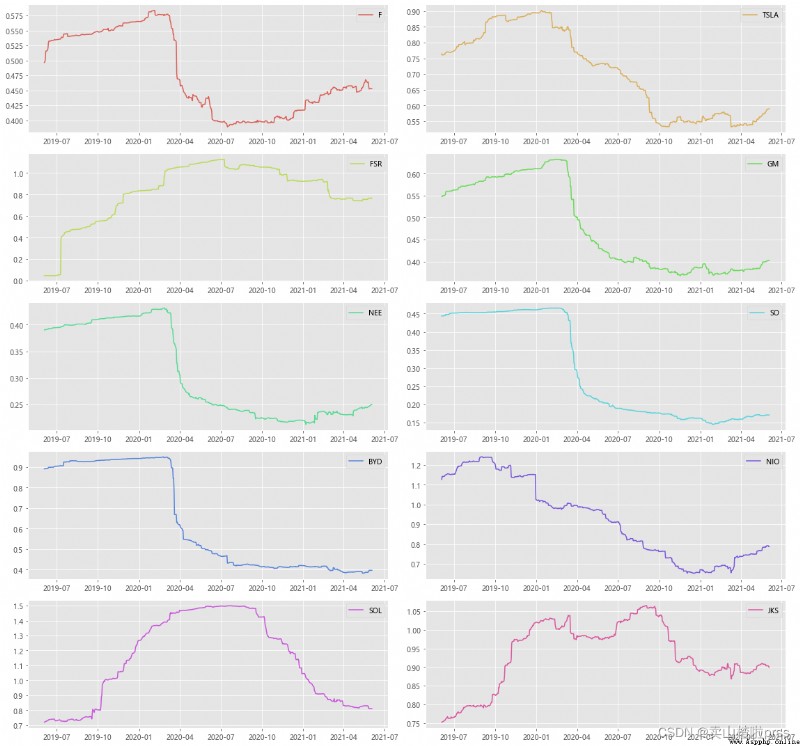

# Cumulative daily yield

# The cumulative daily rate of return helps to determine the value of the investment on a regular basis . The cumulative daily yield can be calculated using the daily percentage change , Just add 1 And calculate the cumulative product .

# The cumulative daily rate of return is calculated relative to the investment . If the cumulative daily yield exceeds 1, Is making a profit , Otherwise, it will be a loss .

plt.style.use('ggplot')

plt.rcParams['font.sans-serif']=['Microsoft YaHei']

fig = plt.figure(figsize = (16,12))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

cc = (1+stocks[j].pct_change()).cumprod()

cc.plot(kind='line', style=['-'],color=color_palette[i],label=j)

plt.xlabel('')

plt.title('{} - Cumulative daily return'.format(j))

plt.legend()

plt.tight_layout()

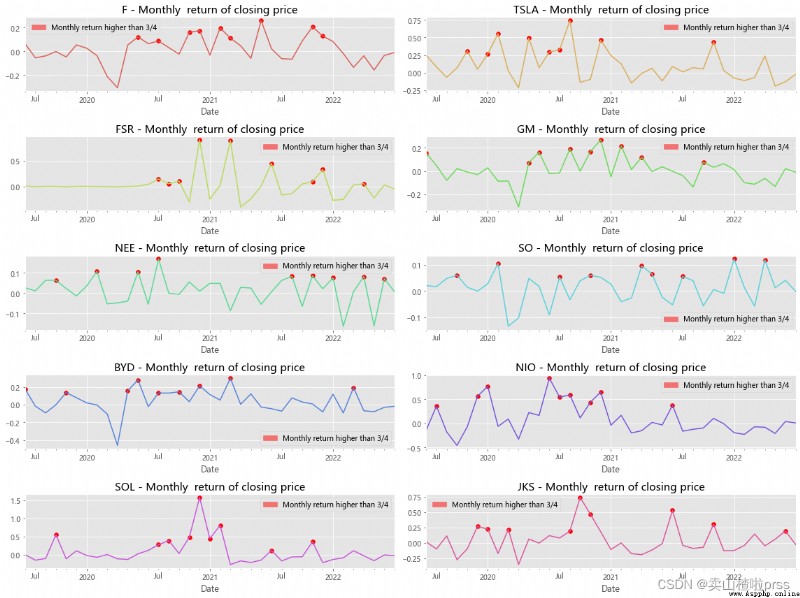

Monthly return of closing price

# Monthly yield

# Visual analysis of monthly yield , Mark the points where the yield is higher than the third quarter .

# The monthly yield fluctuates around the moving average

fig = plt.figure(figsize = (16,12))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

daily_ret = stocks[j].pct_change()

mnthly_ret = daily_ret.resample('M').apply(lambda x : ((1+x).prod()-1))

mnthly_ret.plot(color=color_palette[i]) # Monthly return

start_date=mnthly_ret.index[0]

end_date=mnthly_ret.index[-1]

plt.xticks(pd.date_range(start_date,end_date,freq='Y'),[str(y) for y in range(start_date.year+1,end_date.year+1)])

# Show points with monthly yield greater than 3/4 quantile

dates=mnthly_ret[mnthly_ret>mnthly_ret.quantile(0.75)].index

for i in range(0,len(dates)):

plt.scatter(dates[i], mnthly_ret[dates[i]],color='r')

labs = mpatches.Patch(color='red',alpha=.5, label="Monthly return higher than 3/4")

plt.title('%s - Monthly return of closing price'%j,size=15)

plt.legend(handles=[labs])

plt.tight_layout()

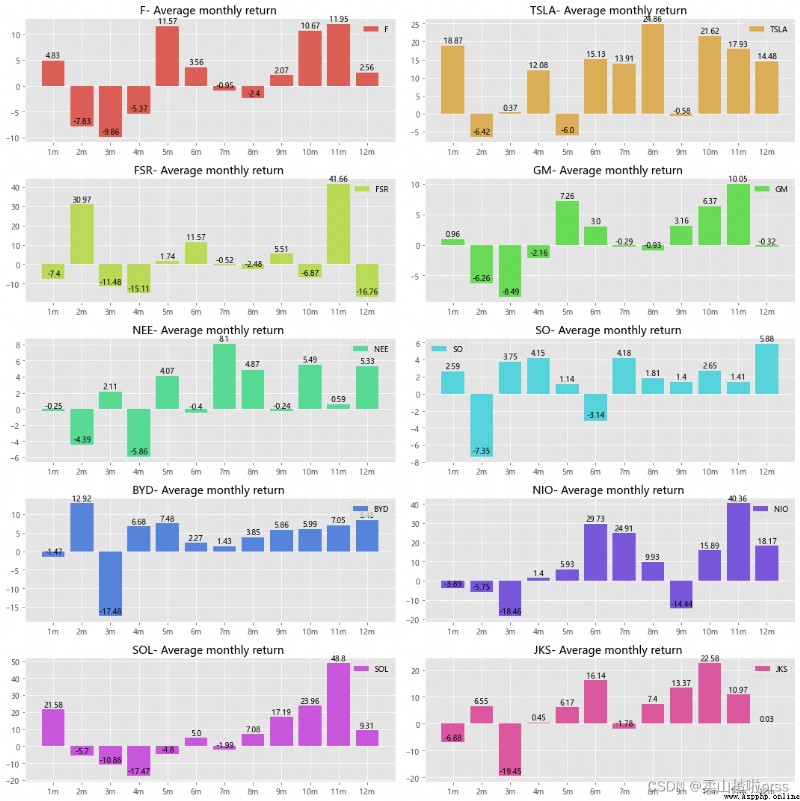

Average monthly return

# Average monthly earnings

plt.style.use('ggplot')

plt.rcParams['font.sans-serif']=['Microsoft YaHei']

fig = plt.figure(figsize = (15,15))

for i,j in enumerate(tickers):

plt.subplot(5,2,i+1)

daily_ret = stocks[j].pct_change()

mnthly_ret = daily_ret.resample('M').apply(lambda x : ((1+x).prod()-1))

mrets=(mnthly_ret.groupby(mnthly_ret.index.month).mean()*100).round(2)

attr=[str(i)+'m' for i in range(1,13)]

v=list(mrets)

plt.bar(attr, v,color=color_palette[i],label=j)

for a, b in enumerate(v):

plt.text(a, b+0.08,b,ha='center',va='bottom')

plt.title('{}- Average monthly return '.format(j))

plt.legend()

plt.tight_layout()

# The graph shows that some months have a positive average yield , And some months have negative average returns ,

Three year compound annual growth rate (CAGR)

Compound annual growth rate (Compound Annual Growth Rate,CAGR) It is the annual growth rate of an investment in a specific period

CAGR=( Existing value / Basic value )^(1/ number of years ) - 1 or (end/start)^(1/# years)-1

It is a constant rate of return over time . In other words , This ratio tells you that at the end of the investment period , What you really get . Its purpose is to describe the expected value obtained by transforming a return on investment into a more stable return on investment .

# Compound annual growth rate (CAGR)

for i in tickers:

days = (stocks[i].index[0] - stocks[i].index[-1]).days

CAGR_3 = (stocks[i][-1]/ stocks[i][0])** (365.0/days) - 1

print("%s (CAGR):%s"%(i,str(round(CAGR_3*100,2))+"%"))

F (CAGR):-12.74%

TSLA (CAGR):-63.6%

FSR (CAGR):-0.03%

GM (CAGR):-5.53%

NEE (CAGR):-14.94%

SO (CAGR):-14.14%

BYD (CAGR):-26.77%

NIO (CAGR):-44.8%

SOL (CAGR):-34.81%

JKS (CAGR):-29.16%

Annualized rate of return

# Annualized rate of return

# Annualized rate of return , It is an important standard to judge whether a stock has investment value !

# Annualized rate of return , That is, the annual dividend per share divided by the share price

for i in tickers:

r_daily_mean = ((1+stocks[i].pct_change()).prod())**(1/stocks[i].shape[0])-1

annual_rets = (1+r_daily_mean)**252-1

print("%s'annualized rate of return is:%s"%(i,str(round(annual_rets*100,2))+"%"))

F’annualized rate of return is:14.56%

TSLA’annualized rate of return is:174.14%

FSR’annualized rate of return is:0.03%

GM’annualized rate of return is:5.84%

NEE’annualized rate of return is:17.53%

SO’annualized rate of return is:16.43%

BYD’annualized rate of return is:36.45%

NIO’annualized rate of return is:80.92%

SOL’annualized rate of return is:53.24%

JKS’annualized rate of return is:41.06%

maximum drawdowns

Maximum withdrawal rate (Maximum Drawdown), It is used to measure in portfolio value , Before the next peak , The maximum single drop between the highest and lowest points . In other words , This value represents the portfolio risk based on a strategy .

“ The maximum pullback rate refers to pushing back at any historical point in the selected cycle , The maximum value of the rate of return retreat when the net product value reaches the lowest point . Maximum pullback is used to describe the worst possible situation after buying a product . Maximum pullback is an important risk indicator , For hedge funds and quantitative strategy trading , This indicator is more important than volatility .”

The maximum pullback rate exceeds the risk tolerance , It is advisable to choose carefully .

# Maximum withdrawal rate

def getMaxDrawdown(x):

j = np.argmax((np.maximum.accumulate(x) - x) / x)

if j == 0:

return 0

i = np.argmax(x[:j])

d = (x[i] - x[j]) / x[i] * 100

return d

for i in tickers:

MaxDrawdown = getMaxDrawdown(stocks[i])

print("%s maximum drawdowns:%s"%(i,str(round(MaxDrawdown,2))+"%"))

F maximum drawdowns:59.97%

TSLA maximum drawdowns:60.63%

FSR maximum drawdowns:0%

GM maximum drawdowns:57.53%

NEE maximum drawdowns:35.63%

SO maximum drawdowns:38.43%

BYD maximum drawdowns:77.43%

NIO maximum drawdowns:79.77%

SOL maximum drawdowns:88.88%

JKS maximum drawdowns:65.44%

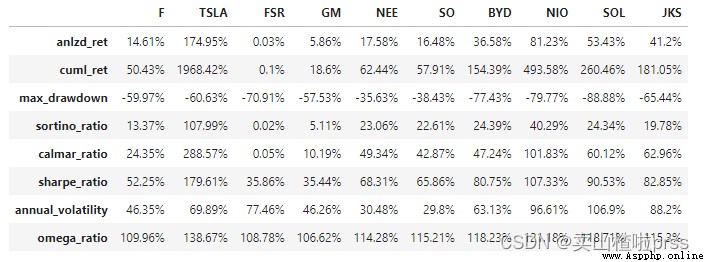

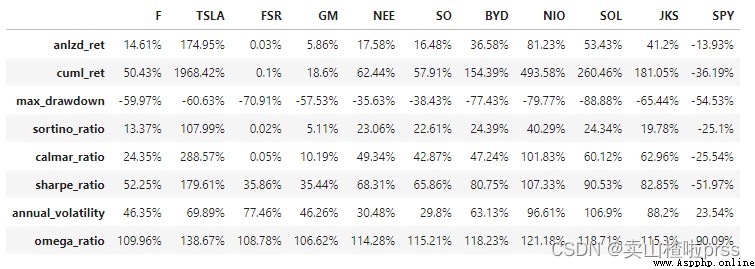

calmer ratios for the top performers

# calmar rate

# Calmar ratio (Calmar Ratio) It describes the relationship between return and maximum pullback . The calculation method is the ratio between the annualized rate of return and the historical maximum pullback .

# Calmar The larger the ratio is , The better the stock performs .

def performance(i):

a = stocks[i].pct_change()

s = a.values

idx = a.index

tss = TSeries(s, index=idx)

dd={

}

dd['anlzd_ret']=str(round(tss.anlzd_ret()*100,2))+"%"

dd['cuml_ret']=str(round(tss.cuml_ret()*100,2))+"%"

dd['max_drawdown']=str(round(tss.max_drawdown()*100,2))+"%"

dd['sortino_ratio']=str(round(tss.sortino_ratio(freq=250),2))+"%"

dd['calmar_ratio']=str(round(tss.calmar_ratio()*100,2))+"%"

dd['sharpe_ratio'] = str(round(sharpe_ratio(tss)*100,2))+"%" # Sharp ratio (Sharpe Ratio): Risk adjusted return . Calculate the total risk per unit of the portfolio , How much excess compensation will be generated .

dd['annual_volatility'] = str(round(stats.annual_volatility(tss)*100,2))+"%" # Volatility

dd['omega_ratio'] = str(round(omega_ratio(tss)*100,2))+"%" # omega_ratio

df=pd.DataFrame(dd.values(),index=dd.keys(),columns = [i])

return df

dff = pd.DataFrame()

for i in tickers:

dd = performance(i)

dff = pd.concat([dff,dd],axis=1)

dff

Volatility

# Annual volatility of daily yield ( rolling )

fig = plt.figure(figsize = (16,15))

for ii,jj in enumerate(tickers):

plt.subplot(5,2,ii+1)

vol = stocks[jj].pct_change()[::-1].rolling(window=252,center=False).std()* np.sqrt(252)

plt.plot(vol,color=color_palette[ii],label=jj)

plt.legend()

plt.tight_layout()

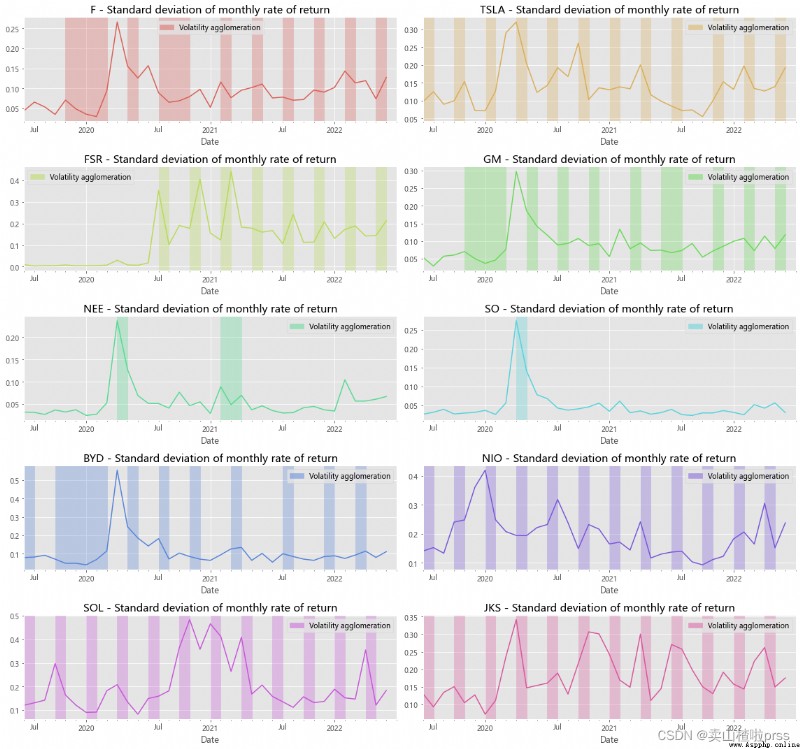

# Annualized standard deviation (volatility) of monthly return

# The annualized standard deviation of the monthly yield ( Volatility )

# Empirical research shows that , Standard deviation of yield ( Volatility ) There is a certain agglomeration phenomenon ,

# That is, high volatility and low volatility tend to gather together , And the periods of high volatility and low volatility are alternating .

# The red department shows , All stocks have certain volatility agglomeration .

fig = plt.figure(figsize = (16,15))

for ii,jj in enumerate(tickers):

plt.subplot(5,2,ii+1)

daily_ret=stocks[jj].pct_change()

mnthly_annu = daily_ret.resample('M').std()* np.sqrt(12)

#plt.rcParams['figure.figsize']=[20,5]

mnthly_annu.plot(color=color_palette[ii],label=jj)

start_date=mnthly_annu.index[0]

end_date=mnthly_annu.index[-1]

plt.xticks(pd.date_range(start_date,end_date,freq='Y'),[str(y) for y in range(start_date.year+1,end_date.year+1)])

dates=mnthly_annu[mnthly_annu>0.07].index

for i in range(0,len(dates)-1,3):

plt.axvspan(dates[i],dates[i+1],color=color_palette[ii],alpha=.3)

plt.title('%s - Standard deviation of monthly rate of return'%jj,size=15)

labs = mpatches.Patch(color=color_palette[ii],alpha=.5, label="Volatility agglomeration")

plt.legend(handles=[labs])

plt.tight_layout()

Pairs Trading

# Pairing strategy

# Analysis object:BYD&GM

# Comparison of closing price line chart

ax1 = BYD.plot(y='Close',label='BYD',figsize=(16,8))

GM.plot(ax=ax1,y='Close',label='GM')

plt.title('Closing price comparison')

plt.xlabel('Date')

plt.ylabel('Close')

plt.grid(True)

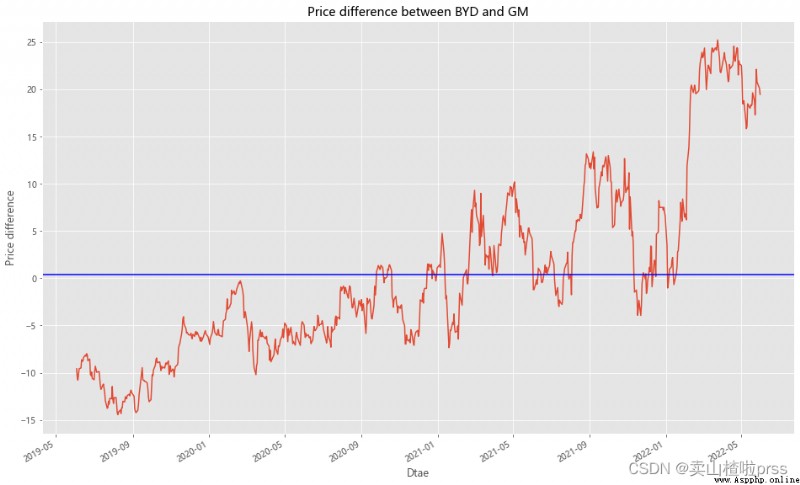

# Price difference and its mean value

# Closing price spread and its mean value

BYD['diff'] =BYD['Close']-GM['Close']

BYD['diff'].plot(figsize=(16,10))

plt.title('Price difference between BYD and GM')

plt.xlabel('Dtae')

plt.ylabel('Price difference')

plt.axhline(BYD['diff'].mean(),color='blue')

plt.grid(True)

# Maximum deviation point

# Maximum closing spread

BYD['diff'][BYD['diff']==max(BYD['diff'])]

Date

2022-03-25 25.214

Name: diff, dtype: float64

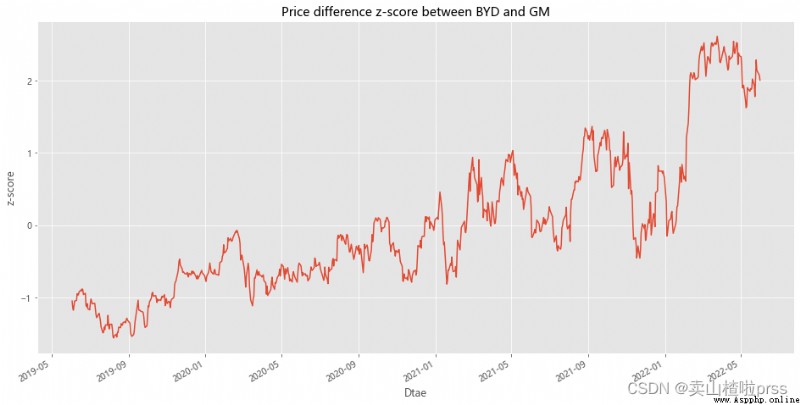

# Measure how far the series deviates from the mean

# measurement BYD and GM The difference between the closing prices of the two stocks The degree of deviation from the average

# Standardize the price difference

BYD['zscore'] =(BYD['diff']-np.mean(BYD['diff']))/np.std(BYD['diff'])

BYD['zscore'].plot(figsize=(16,8))

plt.title('Price difference z-score between BYD and GM')

plt.xlabel('Dtae')

plt.ylabel('z-score')

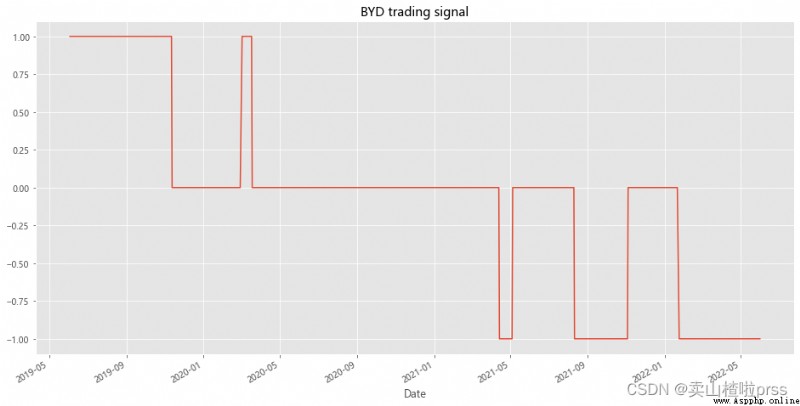

# BYD trading signal

# BYD Stock trading signals

BYD['position1'] = np.where(BYD['zscore']>1,-1,np.nan) # Greater than 1, long

BYD['position1'] = np.where(BYD['zscore']<-1,1,BYD['position1']) # Less than -1, short

BYD['position1'] = np.where(abs(BYD['zscore'])<0.5,0,BYD['position1']) # Close positions within 0.5 range

BYD['position1'] = BYD['position1'].ffill().fillna(0)

BYD['position1'].plot(ylim=[-1.1,1.1],title='BYD trading signal',xlabel='Date',figsize=(16,8))

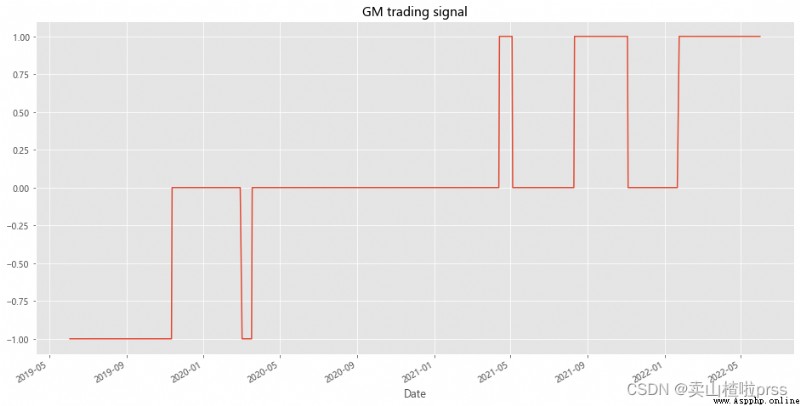

# GM trading signal

# GM Stock trading signals

BYD['position2'] = -np.sign(BYD['position1']) # Opposite to BYD

BYD['position2'].plot(ylim=[-1.1,1.1],title='GM trading signal',xlabel='Date',figsize=(16,8))

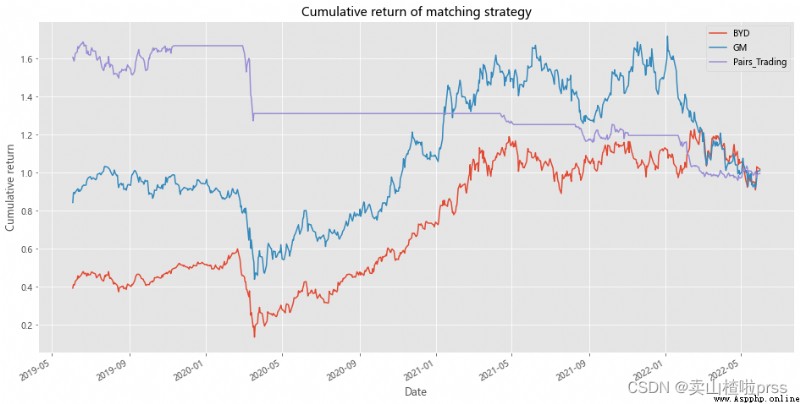

# Cumulative return of strategy

# Cumulative yield of pairing strategy

BYD['BYD']=(np.log(BYD['Close']/BYD['Close'].shift(1))).fillna(0)

BYD['GM']=(np.log(GM['Close']/GM['Close'].shift(1))).fillna(0)

BYD['Pairs_Trading']=0.5*(BYD['position1'].shift(1)*BYD['BYD'])+0.5*(BYD['position2'].shift(1)*BYD['GM'])

BYD[['BYD','GM','Pairs_Trading']].dropna().cumsum().apply(np.exp).plot(figsize=(16,8))

plt.title('Cumulative return of matching strategy')

plt.xlabel('Date')

plt.ylabel('Cumulative return')

plt.grid(True)

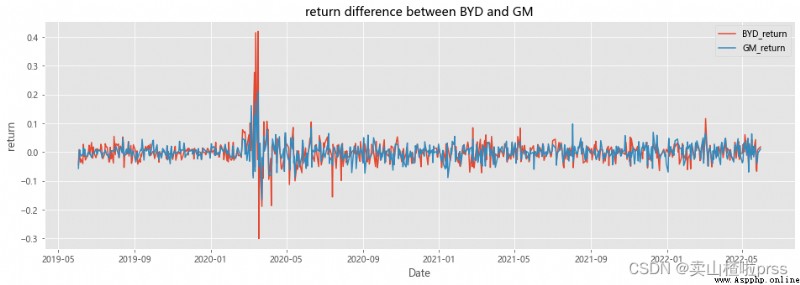

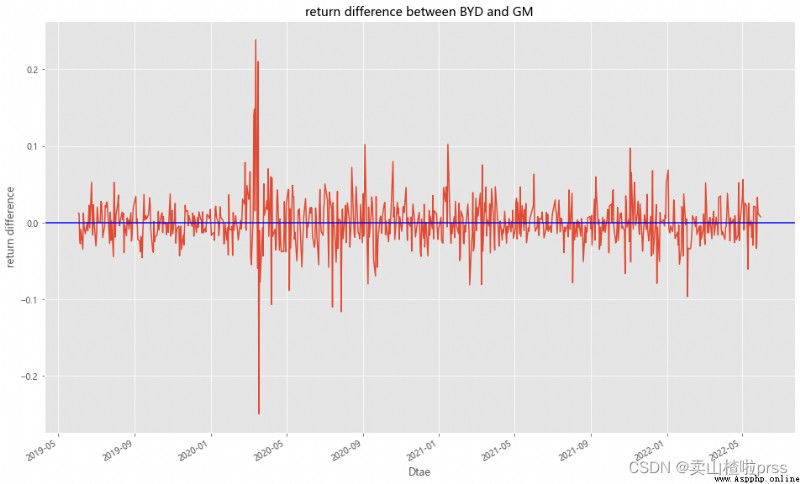

Up and down range analysis

BYD_return = BYD['Close'].pct_change()

GM_return = GM['Close'].pct_change()

BYD['diff_return'] = BYD_return - GM_return

cr = BYD['diff_return'][BYD['diff_return']==BYD['diff_return'].max()]

print(' Maximum yield difference ',cr.values[0])

# Maximum yield difference 0.2384556461576477

fig = plt.figure(figsize = (16,5))

plt.plot(BYD_return.index,BYD_return,label='BYD_return')

plt.plot(GM_return.index,GM_return,label='GM_return')

plt.title('return difference between BYD and GM')

plt.xlabel('Date')

plt.ylabel('return')

plt.legend()

plt.grid(True)

# Difference between rise and fall

BYD['diff_updown'] =BYD_return-GM_return

BYD['diff_updown'].plot(figsize=(16,10))

plt.title('return difference between BYD and GM')

plt.xlabel('Dtae')

plt.ylabel('return difference')

plt.axhline(BYD['diff_updown'].mean(),color='blue')

plt.grid(True)

# Cumulative rise and fall

def profit(closeCol):

try:

p=(closeCol.iloc[-1]-closeCol.iloc[0])/closeCol.iloc[0]*100.00

except Exception:

return None

return round(p,2)

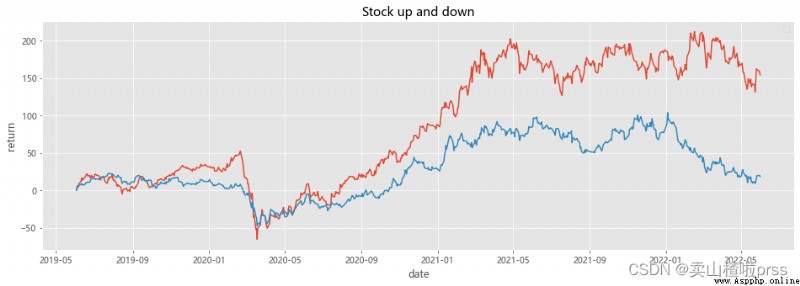

for i in ['BYD','GM']:

closeCol=stocks1[i] # Get the closing price Close The data in this column

babaChange=profit(closeCol)# Call function , Get up and down

print(i,str(babaChange)+'%')

BYD 154.39%

GM 18.6%

# Analysis of stock fluctuation

# Comparison of changes in fixed base increase

def show(stocks, axs=None):

n = []

drawer = plt if axs is None else axs

for i in stocks.columns:

drawer.plot(100*(stocks[i]/stocks[i].iloc[0]-1)) # normalization

drawer.grid(True)

drawer.legend(n, loc='best')

plt.figure(figsize = (16,5))

show(stocks[['BYD','GM']])

plt.title('Stock up and down')

plt.xlabel('date')

plt.ylabel('return')

plt.show()

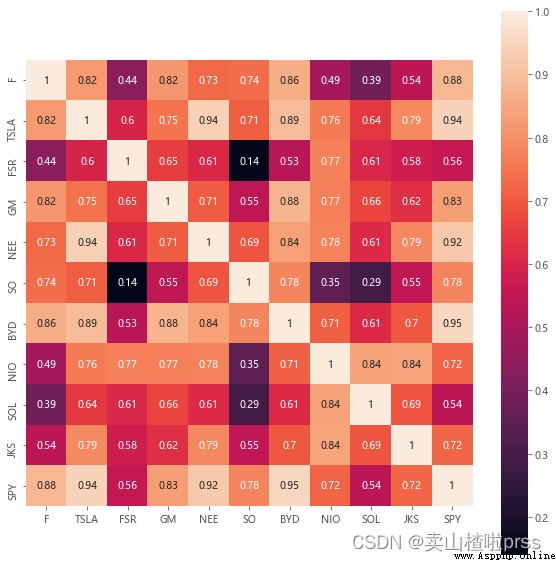

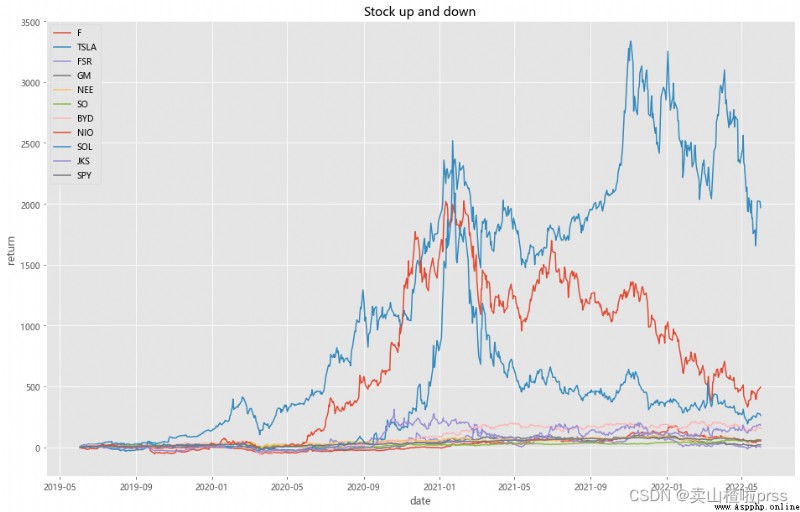

Compare them against two major indices like the S&P 500

# The standard & poor's 500 Index The comparison

SPY = webdata.get_data_stooq('SPY',startDate,endDate)

stocks1 = pd.concat([stocks,SPY['Close']],axis=1)

stocks1.columns = ['F','TSLA','FSR','GM','NEE','SO','BYD','NIO','SOL','JKS','SPY']

stocks1

# Correlation matrix

# SPY And other stocks ( Price ) The correlation —— The last line

plt.figure(figsize = (10,10))

sns.heatmap(stocks1.corr(), annot=True, vmax=1, square=True) # draw df_corr Matrix thermodynamic diagram of

plt.show() # display picture

benchmark = TSeries(SPY['Close'].pct_change()[::-1])

dd={

}

dd['anlzd_ret']=str(round(benchmark.anlzd_ret()*100,2))+"%"

dd['cuml_ret']=str(round(benchmark.cuml_ret()*100,2))+"%"

dd['max_drawdown']=str(round(benchmark.max_drawdown()*100,2))+"%"

dd['sortino_ratio']=str(round(benchmark.sortino_ratio(freq=250),2))+"%"

dd['calmar_ratio']=str(round(benchmark.calmar_ratio()*100,2))+"%"

dd['sharpe_ratio'] = str(round(sharpe_ratio(benchmark)*100,2))+"%" # Sharp ratio (Sharpe Ratio): Risk adjusted return . Calculate the total risk per unit of the portfolio , How much excess compensation will be generated .

dd['annual_volatility'] = str(round(stats.annual_volatility(benchmark)*100,2))+"%" # Volatility

dd['omega_ratio'] = str(round(omega_ratio(benchmark)*100,2))+"%" # omega_ratio

df_benchmark =pd.DataFrame(dd.values(),index=dd.keys(),columns = ['SPY'])

df_benchmark

dff = pd.concat([dff,df_benchmark],axis=1)

dff

# Compare the annualized return of each stock 、 Cumulative income 、 Maximum withdrawal rate 、 Sotino ratio ( Downward volatility of the portfolio ,)、calmar Rate, etc

# Analysis of stock fluctuation

def show(stocks, axs=None):

n = []

drawer = plt if axs is None else axs

for i in stocks.columns:

if i != ' date ':

n.append(i)

drawer.plot(100*(stocks[i]/stocks[i].iloc[0]-1)) # normalization

drawer.grid(True)

drawer.legend(n, loc='best')

plt.figure(figsize = (16,10))

show(stocks)

plt.title('Stock up and down')

plt.xlabel('date')

plt.ylabel('return')

plt.show()

# Calculate the rise and fall of stocks =( Now the stock price - Buying price )/ Buying price

def profit(closeCol):

try:

p=(closeCol.iloc[0]-closeCol.iloc[-1])/closeCol.iloc[-1]*100.00

except Exception:

return None

return round(p,2)

for i in tickers+['SPY']:

closeCol=stocks1[i] # Get the closing price Close The data in this column

babaChange=profit(closeCol)# Call function , Get up and down

print(i,str(babaChange)+'%')

F -33.52%

TSLA -95.17%

FSR -0.1%

GM -15.68%

NEE -38.44%

SO -36.67%

BYD -60.69%

NIO -83.15%

SOL -72.26%

JKS -64.42%

SPY -36.19%

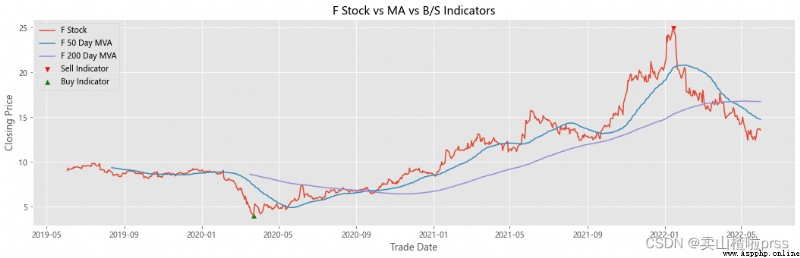

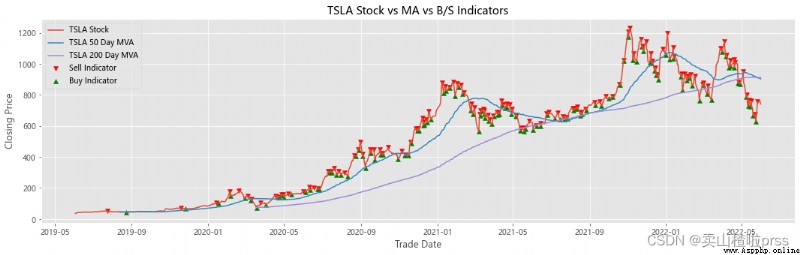

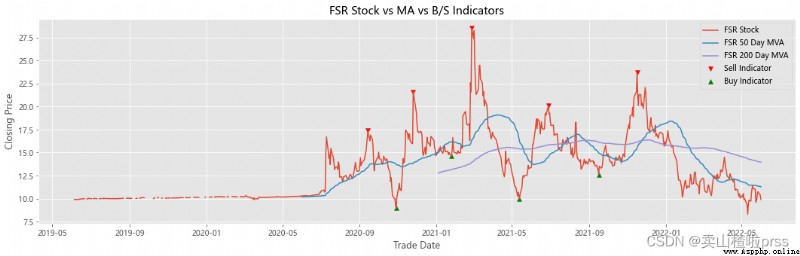

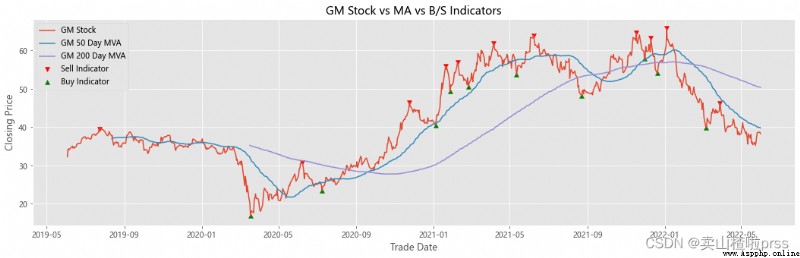

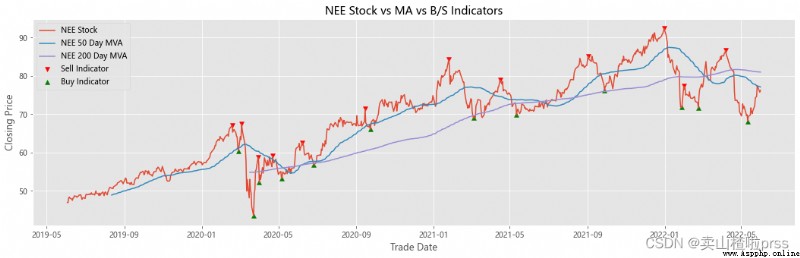

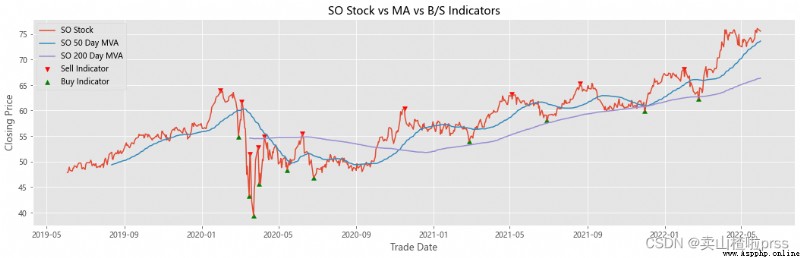

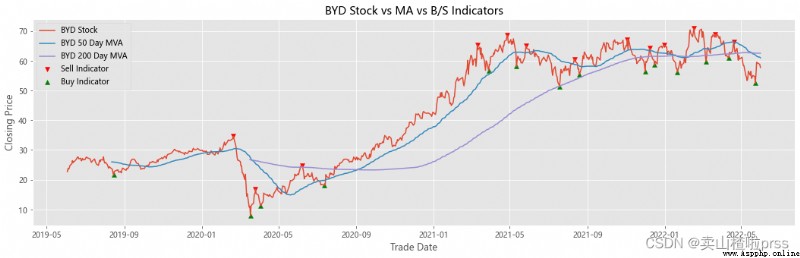

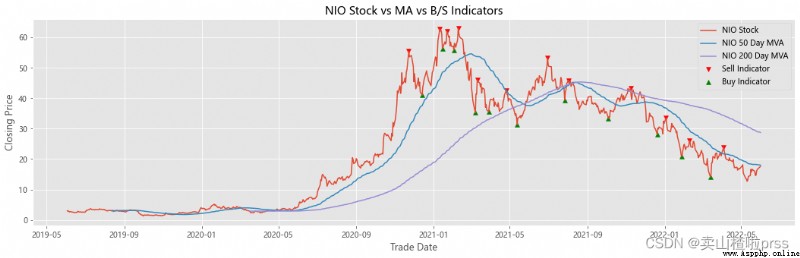

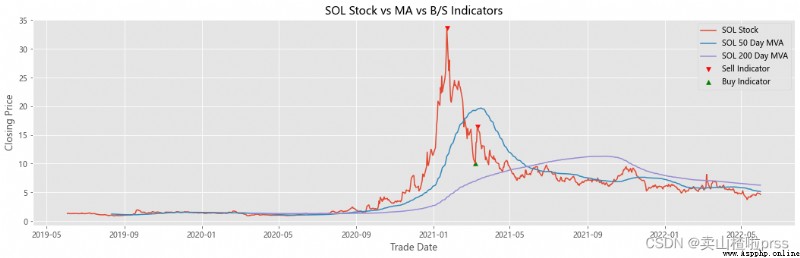

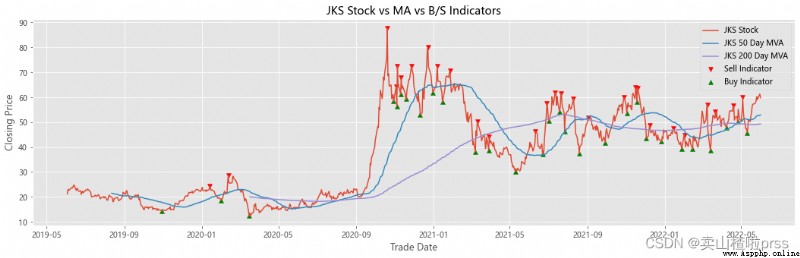

Add stocks, signals and moving averages to plot and visualize

# Stocks 、 Signals and moving averages to plot and visualize

# Check stock stability

# Some retail investors like to use the moving average to judge whether to buy or sell , For example, the common , Five days ma5 Wear the ten day moving average ma10 When buying stocks , On the contrary, sell stocks .

for i in tickers:

stock_close = stocks[i]

## Add stocks, signals and moving averages to plot and visualize

maximaIndex, _ = find_peaks(stock_close, prominence=5)

maxPrices = [stock_close[i] for i in maximaIndex]

minimaIndex, _ = find_peaks(stock_close * (-1), prominence=5)

minPrices = [stock_close[i] for i in minimaIndex]

fig, ax = plt.subplots(figsize = (18,5))

ax.scatter(stock_close.index[maximaIndex], maxPrices, marker='v', color='red', label='Sell Indicator')

ax.scatter(stock_close.index[minimaIndex], minPrices, marker='^', color='green', label='Buy Indicator')

ax.plot(stock_close.index, stock_close, label = '{} Stock'.format(i))

ax.set_xlabel('Trade Date')

ax.set_ylabel('Closing Price')

ax.set_title('{} Stock vs MA vs B/S Indicators'.format(i))

shortRollingMVA = stock_close.rolling(window=50).mean()

longRollingMVA = stock_close.rolling(window=200).mean()

ax.plot(shortRollingMVA.index, shortRollingMVA, label = '{} 50 Day MVA'.format(i))

ax.plot(longRollingMVA.index, longRollingMVA, label = '{} 200 Day MVA'.format(i))

ax.legend()

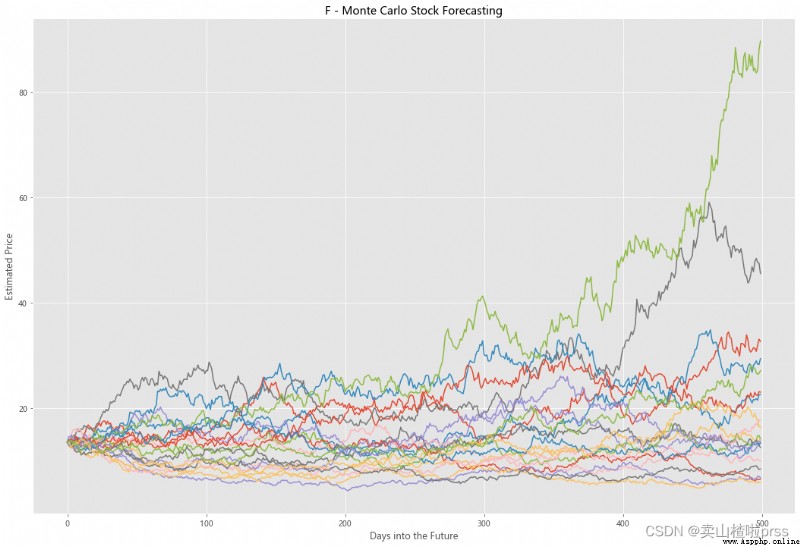

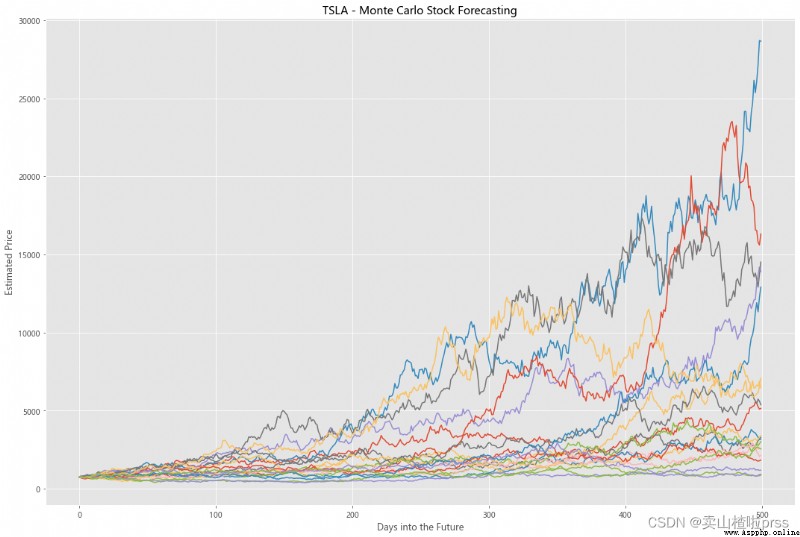

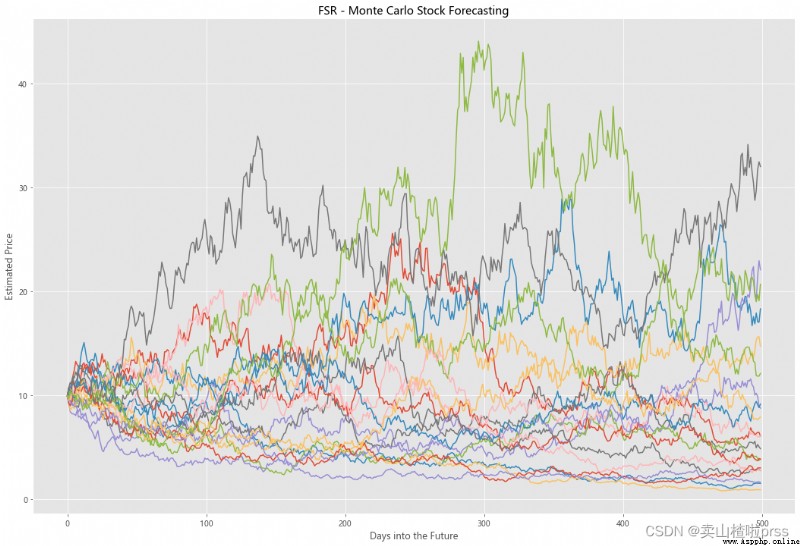

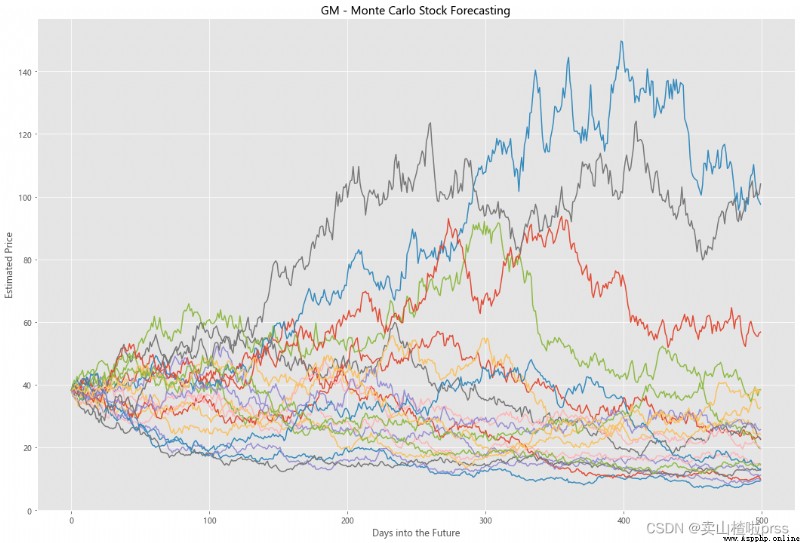

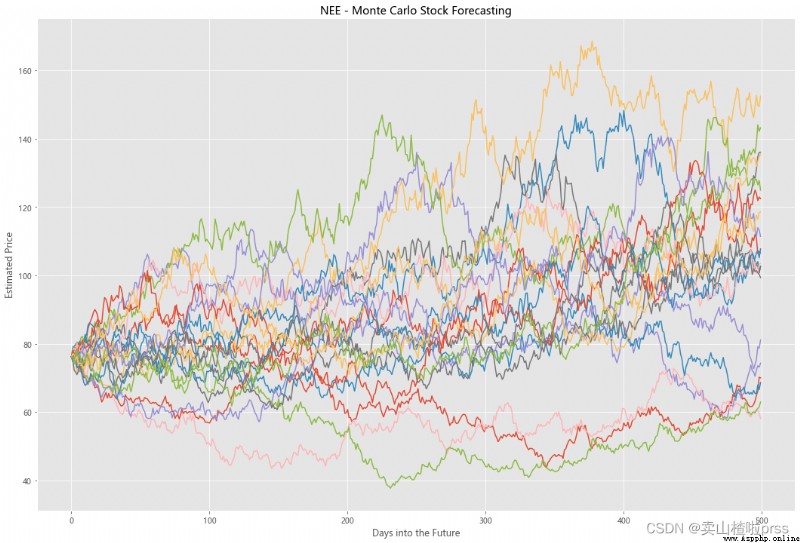

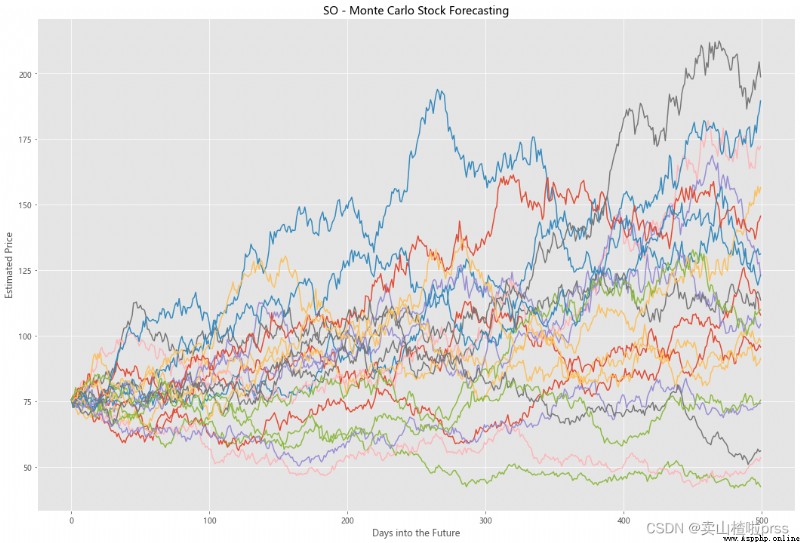

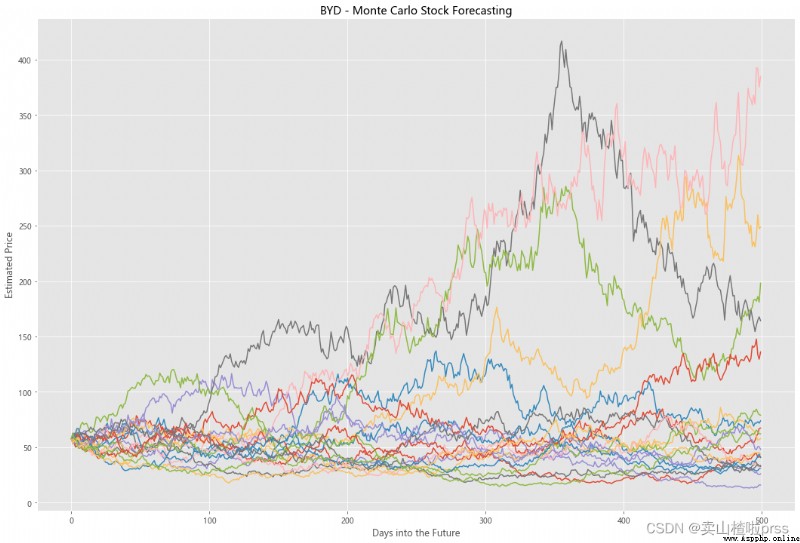

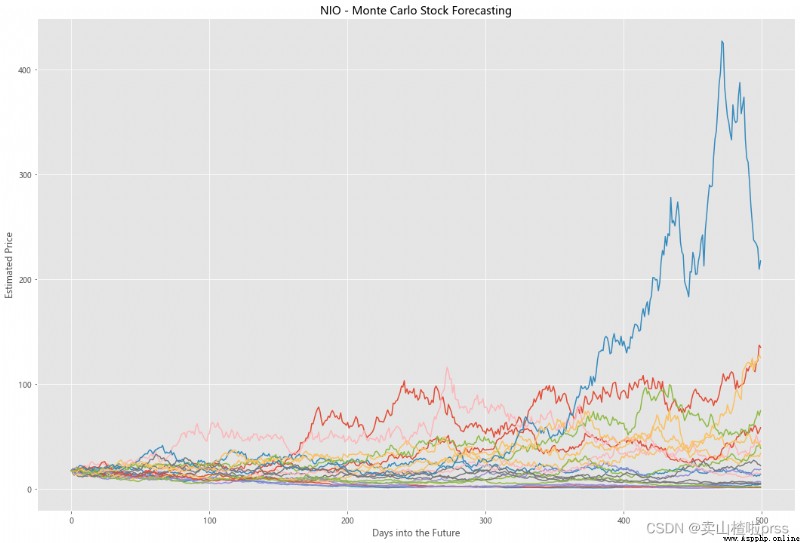

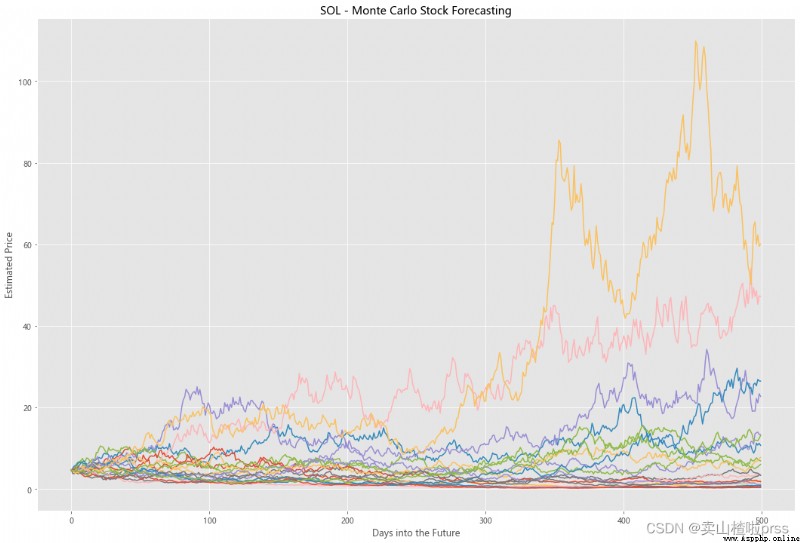

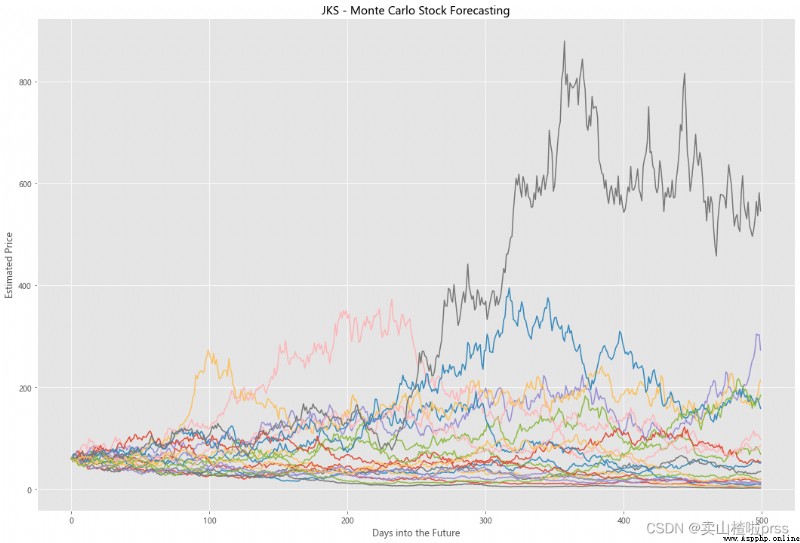

Try to forecast future stock movements via Monte Carlo Simulations

# Predict the future stock trend through Monte Carlo simulation

# Monte Carlo simulation is a statistical method , Used to simulate the evolution trend of data .

# Monte Carlo simulation in which 20 Simulation path diagram

for i in tickers:

stock_close = stocks[i]

logReturns = np.log(1+stock_close.pct_change())

## Need mean and standard deviation to calculate brownian motion (random walk) = r = drift + standard_deviation* e^r

mean = logReturns.mean()

variance = logReturns.var()

### Calculate drift which estimates how far the stock price will move in the future

drift = mean - (0.5 * variance)

standard_deviation = logReturns.std()

### Next needed component of brownina motion is a randomly generated variable, such as Z (Z-score), we are projecting how far the stock will deviate from the mean

simulations = 20

probability_z = norm.ppf(np.random.rand(simulations,2))

time_interval = 500 #Number of days into the future we go

dailyReturns = np.exp(drift + standard_deviation * norm.ppf(np.random.rand(time_interval, simulations))) # Estimate of returns

# Starting point of our analyysis is S_0, which is the last historical trading today (today)

S_0 = stock_close.iloc[-1]

# Create an array with estimated stock movements

prices = np.zeros_like(dailyReturns) # Empty array of 0s

prices[0] = S_0

for t in range(1, time_interval):

prices[t] = prices[t-1] * dailyReturns[t]

figMC, axMC = plt.subplots(figsize = (18,12))

axMC.set_xlabel('Days into the Future')

axMC.set_ylabel('Estimated Price')

axMC.set_title('%s - Monte Carlo Stock Forecasting'%i)

axMC.plot(prices)

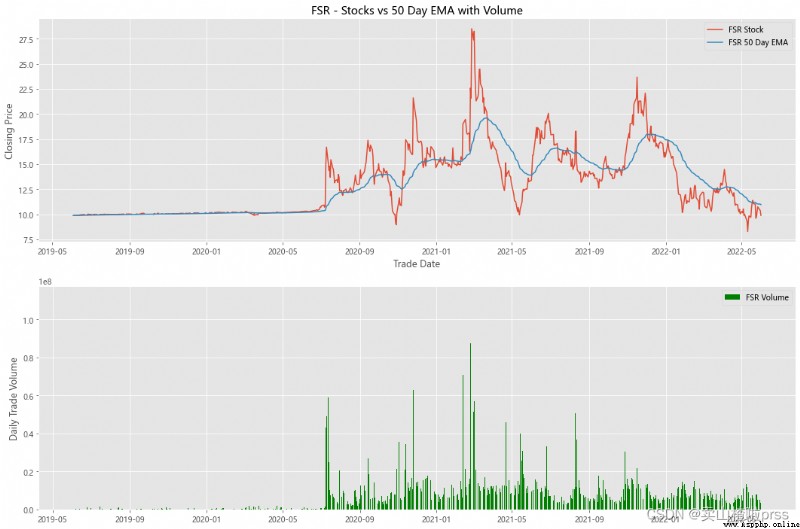

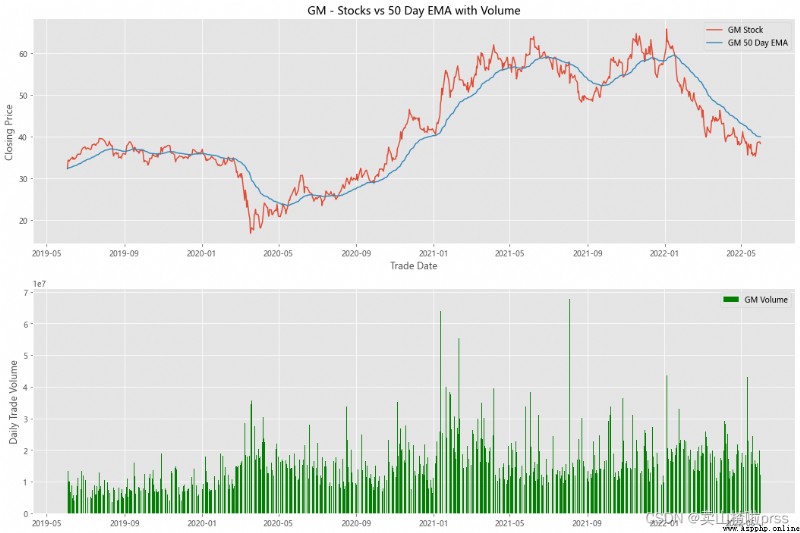

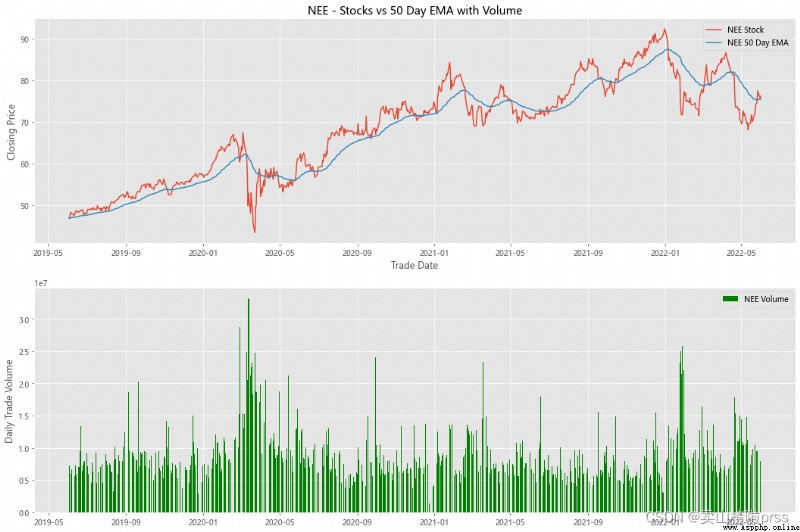

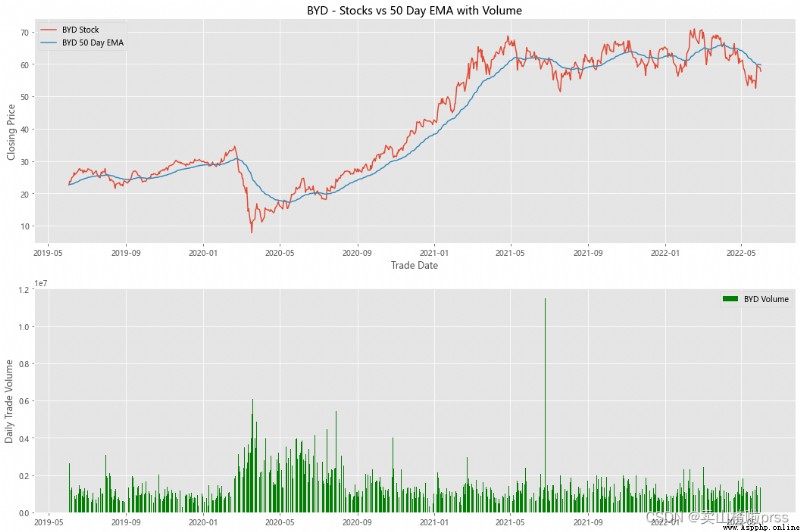

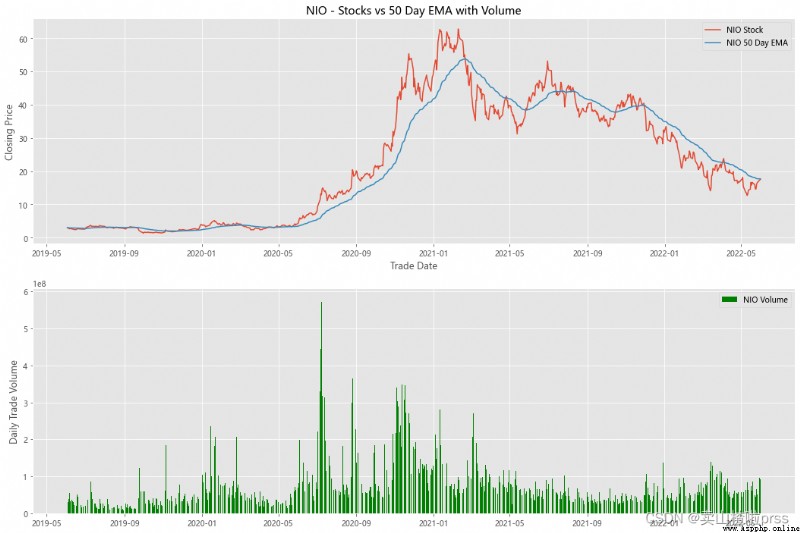

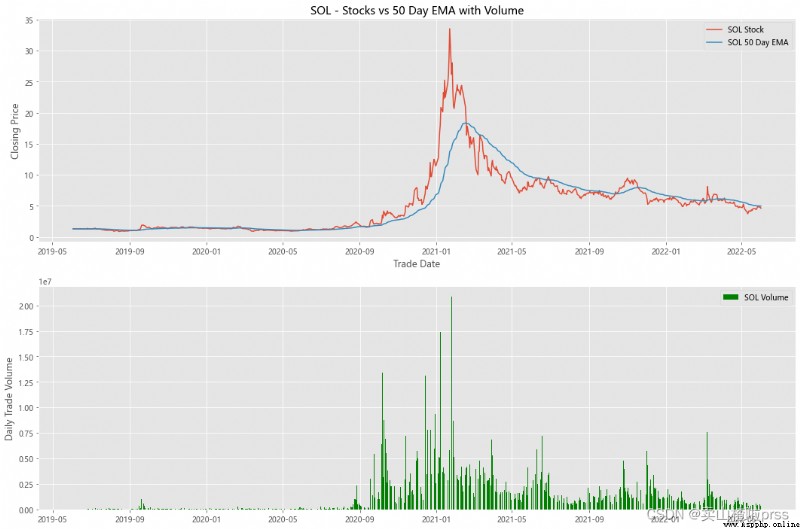

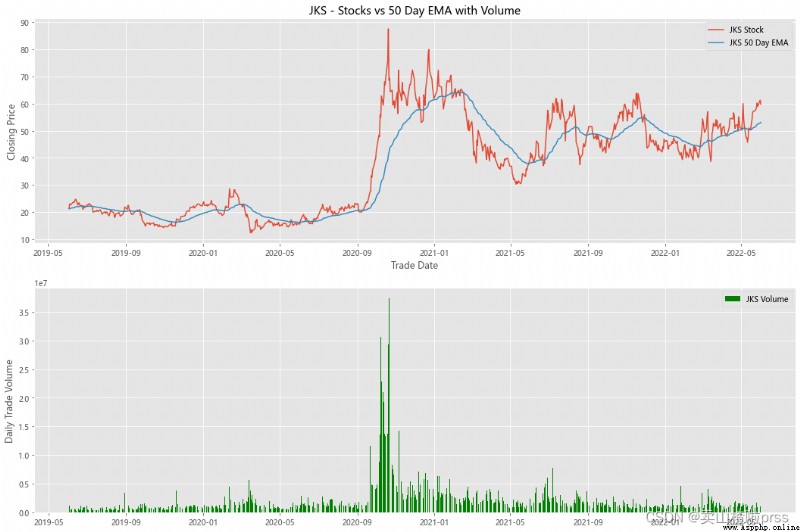

alculate Exponential Moving Averages and Volume

# Calculate the stock index moving average and trading volume

for i in tickers:

stock_close = stocks[i]

fig3, (ax3,ax4) = plt.subplots(2,1,figsize = (18,12))

emaShort = stock_close.ewm(span=50, adjust=False).mean()

ax3.plot(stock_close.index, stock_close, label = '{} Stock'.format(i))

ax3.plot(emaShort.index, emaShort, label = '{} 50 Day EMA'.format(i))

ax3.set_xlabel('Trade Date')

ax3.set_ylabel('Closing Price')

ax3.set_title('%s - Stocks vs 50 Day EMA with Volume'%i)

ax3.legend()

volume = eval(i)['Volume']

ax4.bar(volume.index, volume, label = '{} Volume'.format(i), color='green')

ax4.set_ylabel('Daily Trade Volume')

ax4.legend()

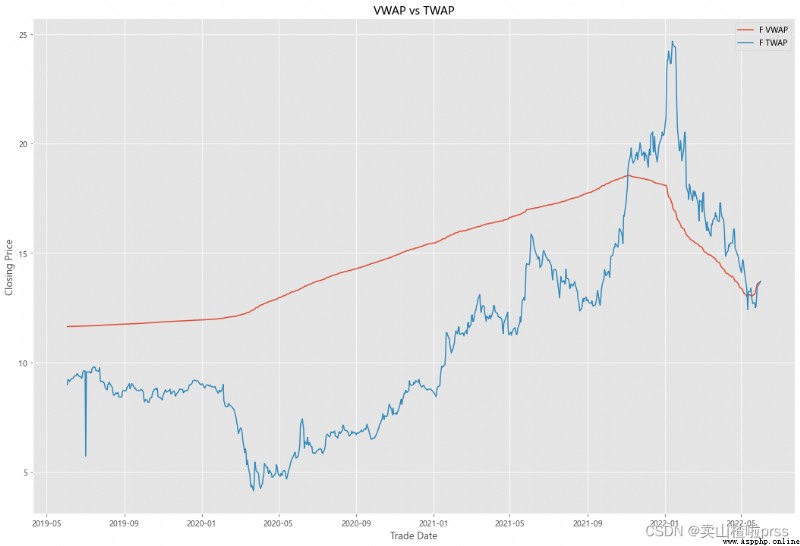

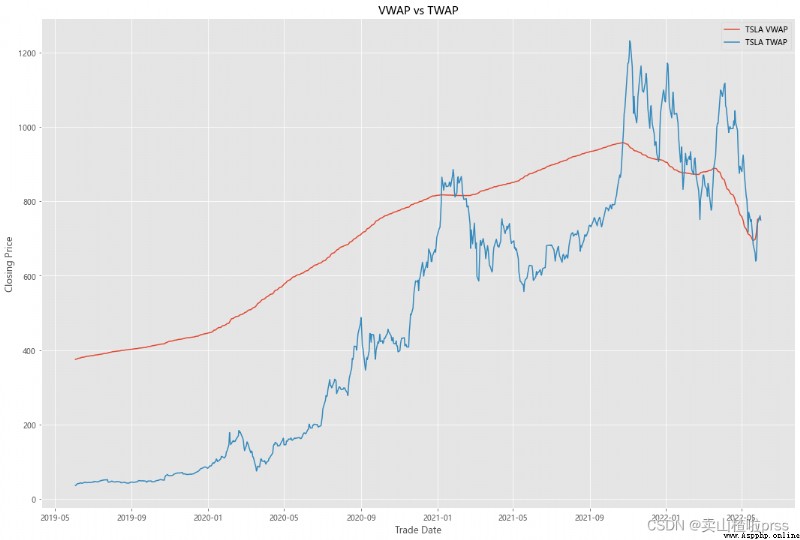

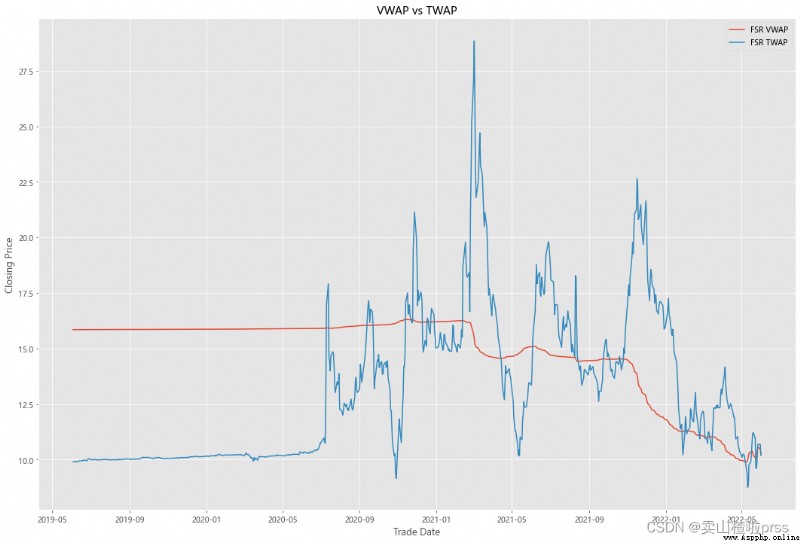

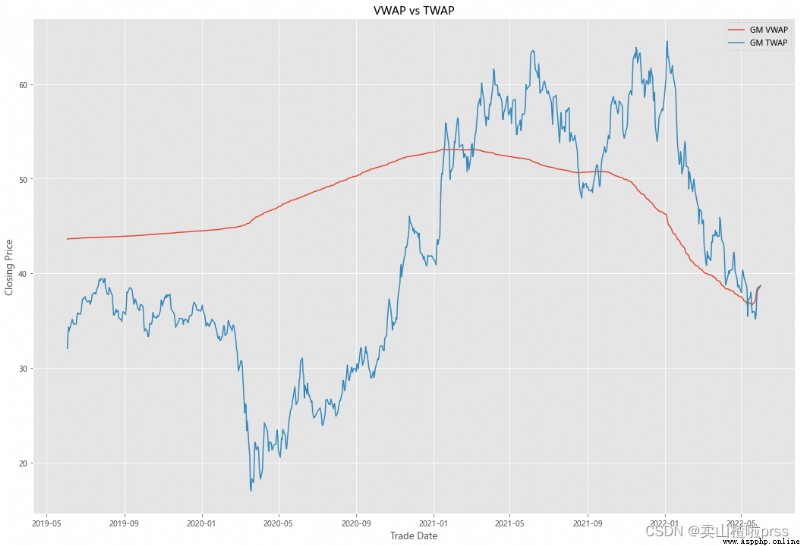

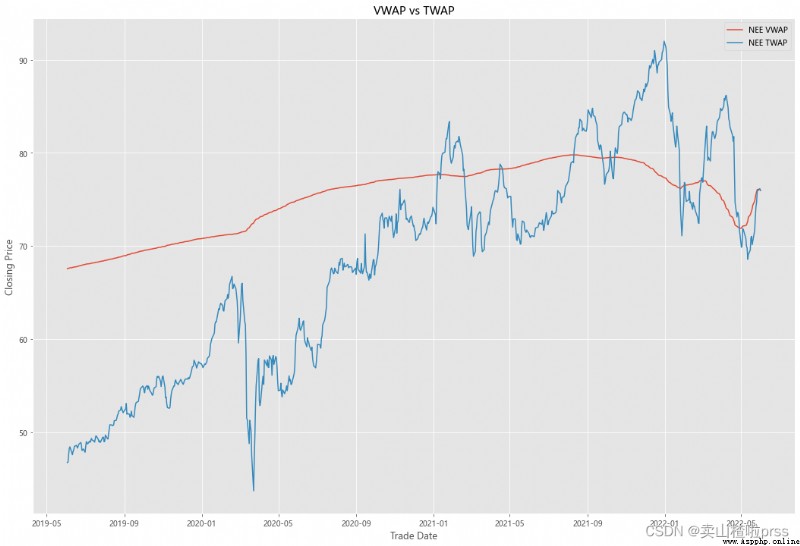

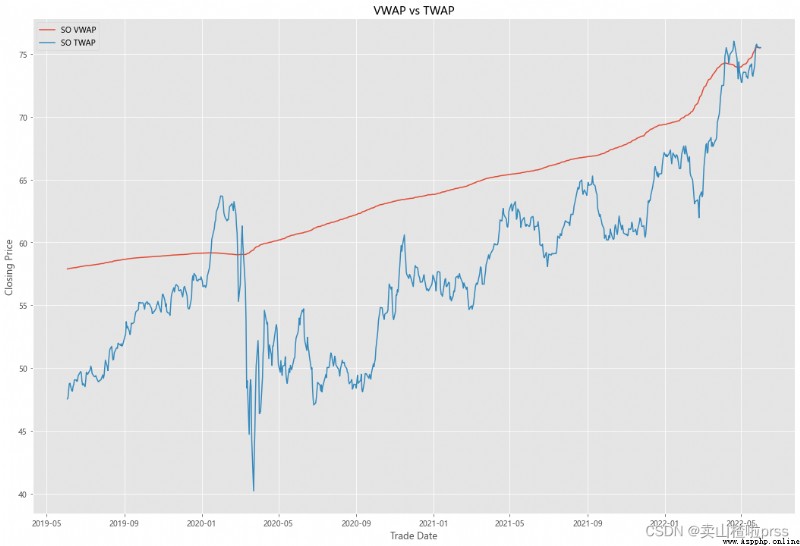

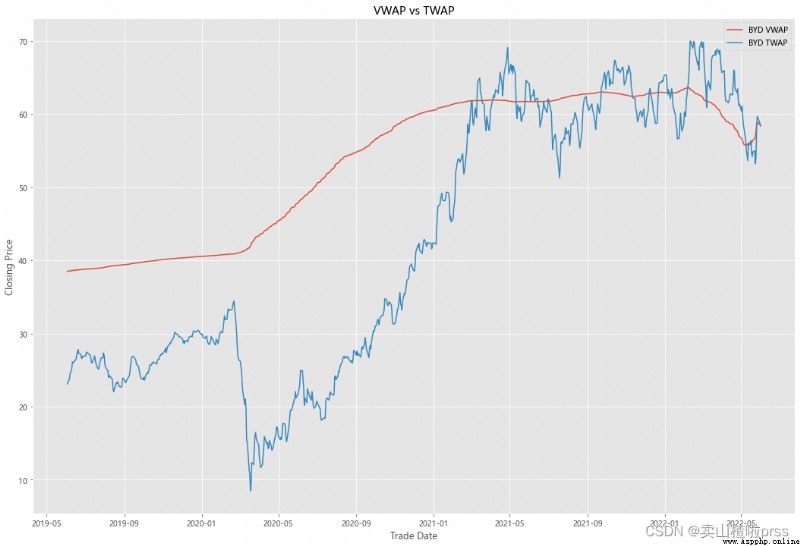

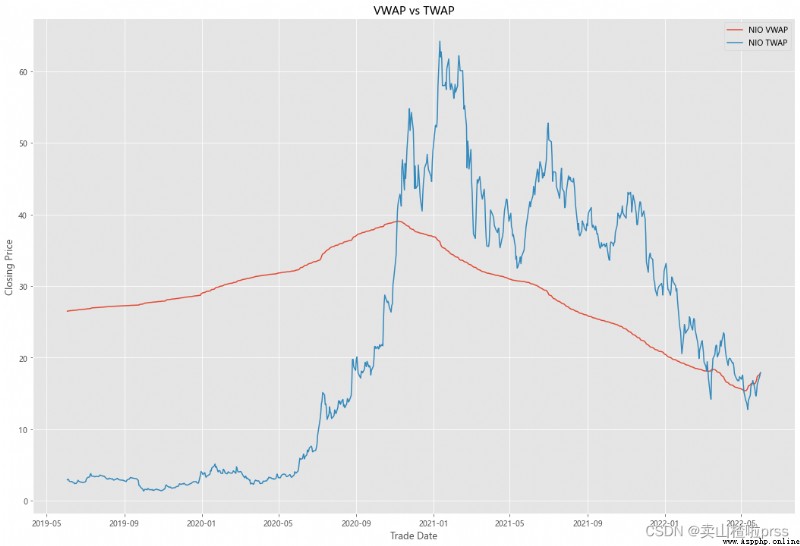

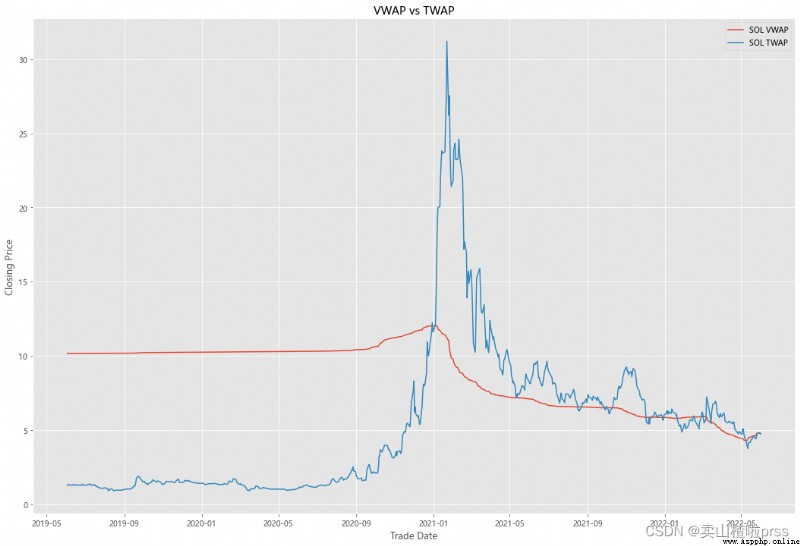

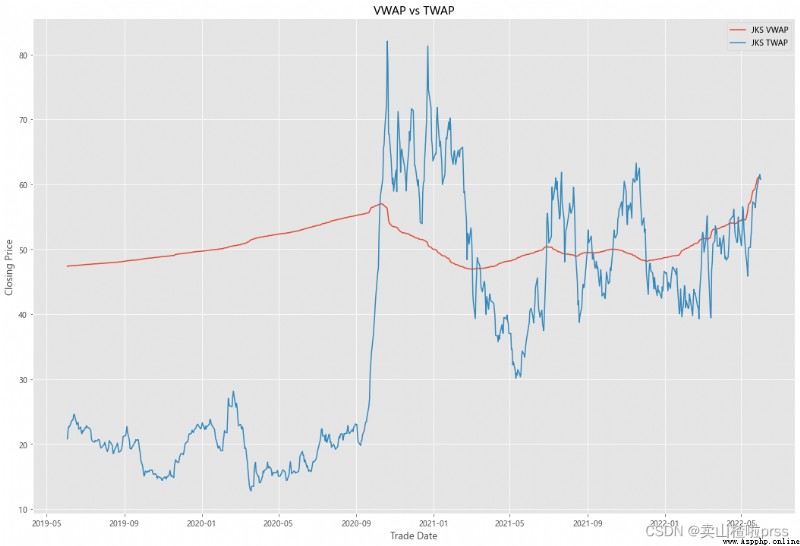

VWAP

#### Quick VWAP Calculation - This is better done with daily intraday data (1 minute ticks), since we dont have that, we are looking at just daily data

for i in tickers:

VWAP = eval(i)

VWAP['cumVol'] = VWAP['Volume'].cumsum()

VWAP['cumVolPrice'] = (VWAP['Volume'] * ((VWAP['High']+VWAP['Low']+VWAP['Open']+VWAP['Close'])/4)).cumsum()

VWAP['VWAP'] = VWAP['cumVolPrice']/VWAP['cumVol']

#### Quick TWAP Calculation

VWAP['TWAP'] = (VWAP['High']+VWAP['Low']+VWAP['Open']+VWAP['Close'])/4

fig5, ax5 = plt.subplots(figsize = (18,12))

ax5.plot(VWAP.index, VWAP['VWAP'], label = '{} VWAP'.format(i))

ax5.plot(VWAP.index, VWAP['TWAP'], label = '{} TWAP'.format(i))

ax5.set_xlabel('Trade Date')

ax5.set_ylabel('Closing Price')

ax5.set_title('VWAP vs TWAP')

ax5.legend()

thus