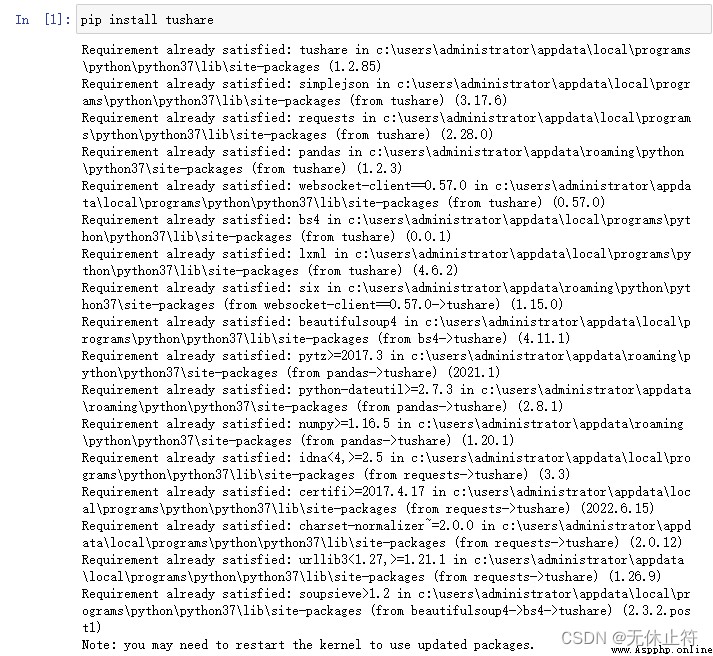

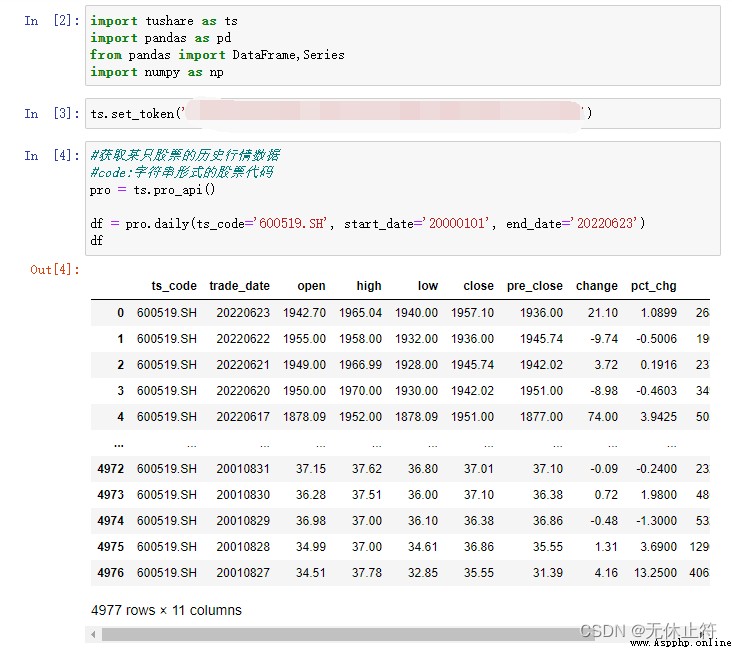

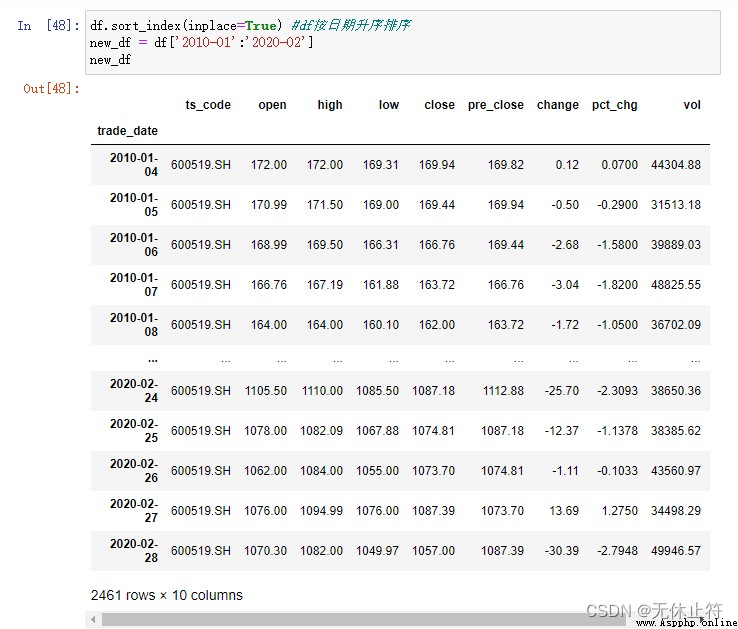

Use tushare Interface to get historical data of stocks :ts.set_token You need to register on the official website , Then you can get your own token

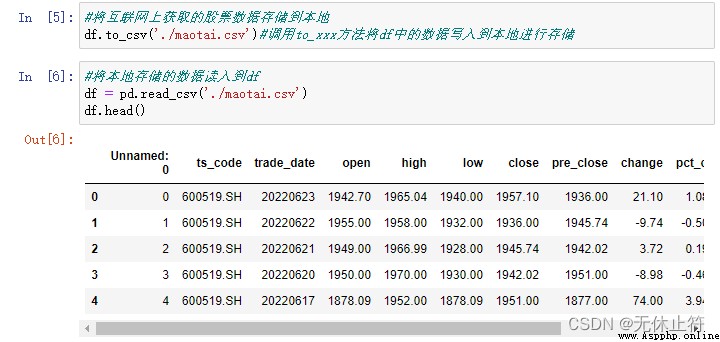

Save the acquired data to the local

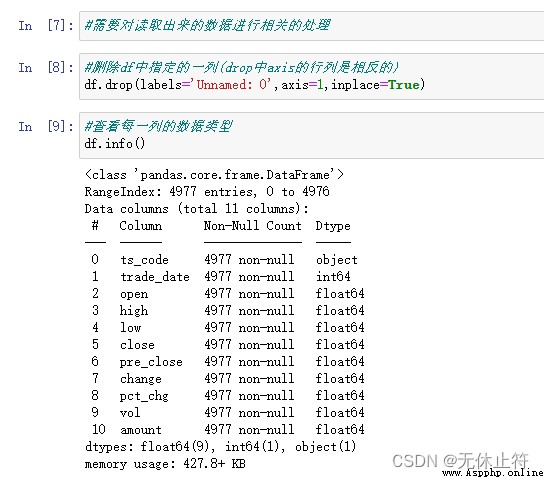

Delete df in Unnamed Column data for

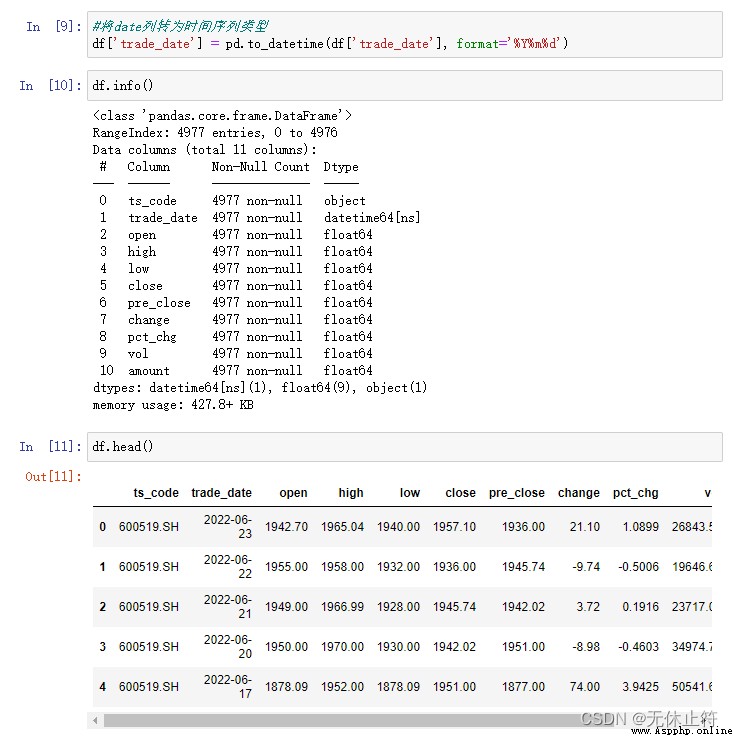

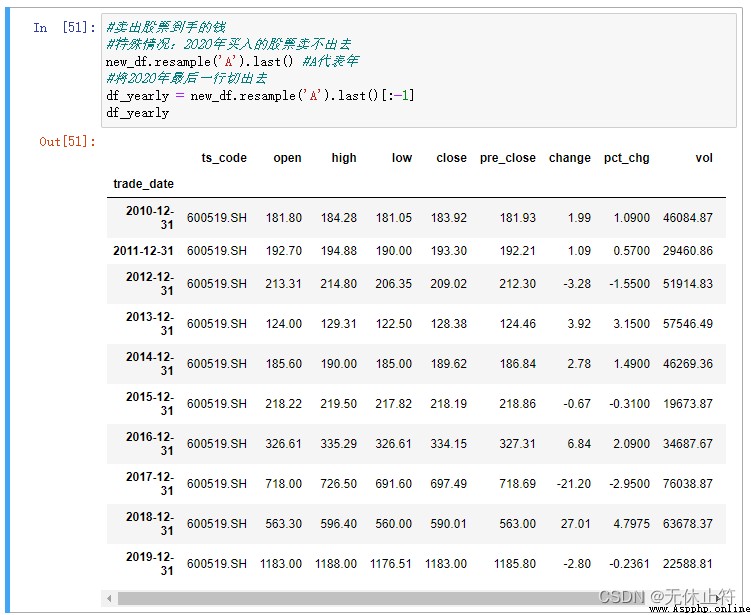

take trade_date To time series type

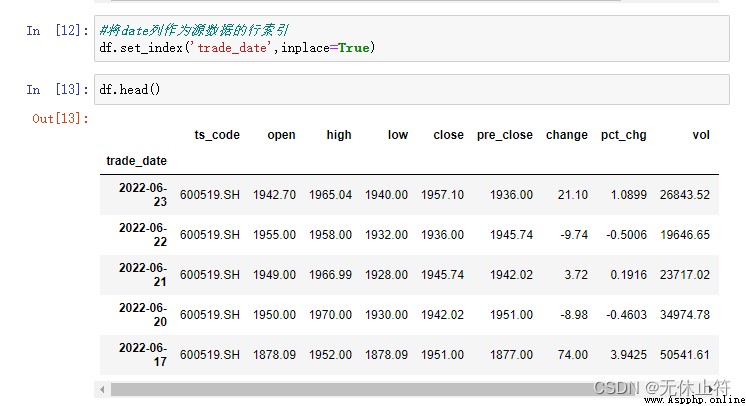

take trade_date As the row index of the source data

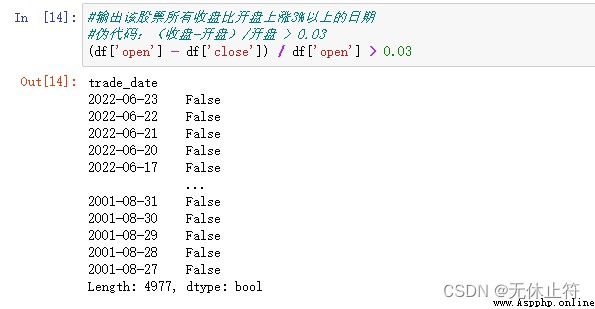

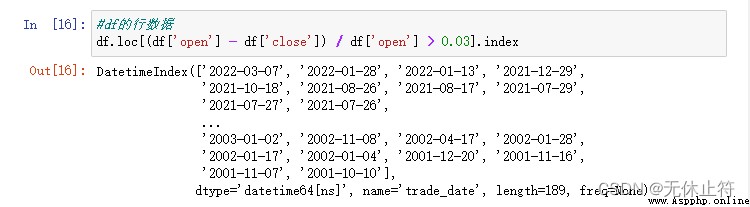

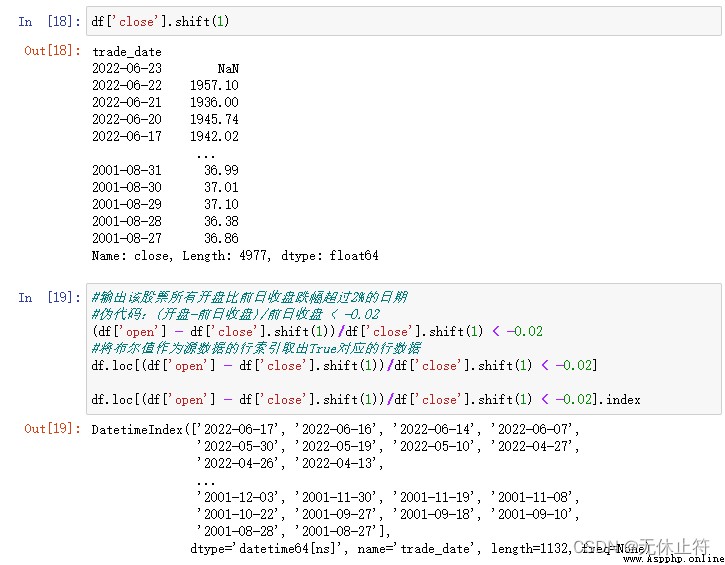

(df['open'] - df['close']) / df['open'] > 0.03: You can set the date when the condition is met to True, Discontented is False

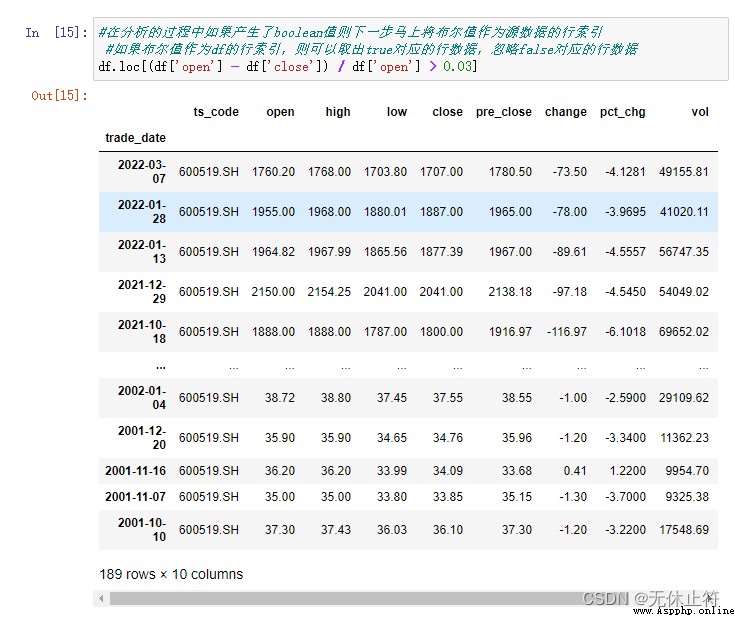

take boolean Value as the index of the source data

Take out the date data

Click to download jupyter note