Hello everyone , I'm Junxin

Not long ago , Received a gift from Tsinghua University Press 《 Explain profound theories in simple language Python Quantitative trading practice 》 A Book , Also promised the publishing house Write some reading notes , I'll hand in my homework today .

Of course the old rule , Junxin will be in this chapter Total gifts 3 This book , See the rules at the end of the text .

Here are some simple attempts I made with reference to the contents of the book , For reference only . This book is for the use of Python Beginners who play quantification , It's still friendly , If you are interested, you can consider starting a book .

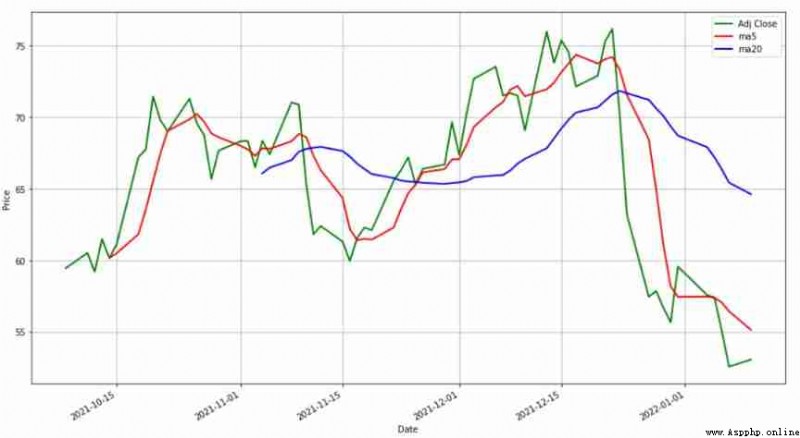

use Python Plot the price of the stock 5 The daily average and 20 ma . as everyone knows ,5 The daily average is the life and death line of short-term trading , and 20 The daily moving average is the watershed of the medium and long-term trend . therefore , Based on these two moving averages , You can design some simple trading strategies .

Here is the code I practiced :

import pandas as pd

import numpy as np

from pandas_datareader import data

import datetime

import matplotlib.pyplot as plt

Import part of the library , No explanation. , Pull data below :

end_date = datetime.date.today()

start_date = end_date - datetime.timedelta(days = 100)

price = data.DataReader('601127.ss','yahoo',

start_date,

end_date)

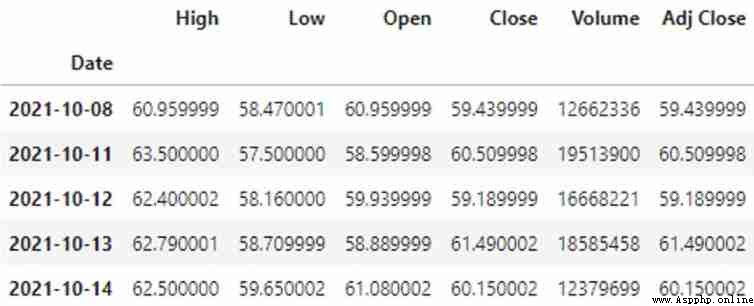

price.head()Here I choose from yahoo PULL 601127 This stock used to 100 Days of market data . Can see the earliest data to 2021 Year of 10 month 8 Japan :

Then I started adding 5 Day and 20 ma

price['ma5'] = price['Adj Close'].rolling(5).mean()

price['ma20'] = price['Adj Close'].rolling(20).mean()

price.tail()You can see in the data :

For the convenience of observation , I drew a picture with code :

fig = plt.figure(figsize=(16,9))

ax1 = fig.add_subplot(111, ylabel='Price')

price['Adj Close'].plot(ax=ax1, color='g', lw=2., legend=True)

price.ma5.plot(ax=ax1, color='r', lw=2., legend=True)

price.ma20.plot(ax=ax1, color='b', lw=2., legend=True)

plt.grid()

plt.show()So you can see the image directly :

In this way, we can design the moving average strategy according to the moving average of different periods .

Here we use the words in the book KNN Trading strategy of mode , Replaced by a logistic regression model , Try to see how the performance of the strategy will change .

Without saying , Go up the ladder , Guide Kula data :

import pandas as pd

import pandas_datareader.data as web

import numpy as np

from datetime import datetimeThere's not much data , To a 3 Year of :

end = datetime.date.today()

start = end - datetime.timedelta(days = 365*3)I'm big A stocks , Best cattle X Shares , To say Maotai , No one is against it ? Let's do the market data of Maotai :

owB = web.DataReader('600519.ss', 'yahoo',

start,

end)

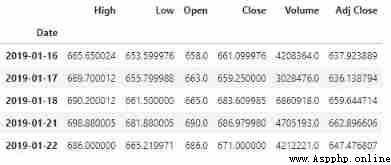

cowB.head()When he pulled it down, Ben Xian was surprised ,2019 year 1 In the month , Da Maotai CAI 600 How much money ! However, it is estimated that benxian was asked to buy , Ben Xian dare not . At that time, I was old A There are not many stocks with more than 100 shares !

Then I follow the method in the book , Do feature Engineering :

cowB['open-close'] = cowB['Open'] - cowB ['Close']

cowB ['high-low'] = cowB ['High'] - cowB ['Low']

cowB ['target'] = np.where(cowB ['Close'].shift(-1) > cowB ['Close'],1,-1)

cowB = cowB.dropna()

cowB.tail()Then there are a few more columns ,target Inside ,1 It means rising the next day ,-1 It means falling the next day :

Now we're going to make a model :

x = cowB [['open-close','high-low']]

y = cowB ['target']Split into x and y, Then please go out scikit-learn:

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LogisticRegressionThen the data set is divided into training set and test set :

x_train, x_test, y_train, y_test =\

train_test_split(x, y, train_size = 0.8)See how logistic regression performs :

lr = LogisticRegression()

lr.fit(x_train, y_train)

print(lr.score(x_train, y_train))

print(lr.score(x_test, y_test))Results found , Not in the book yet KNN The score is high :

0.5438898450946644

0.5136986301369864 The accuracy of logistic regression in the training set is 54.39%, And in the book KNN The accuracy rate is basically the same ; But there are only 51.37%, Than in the book KNN The model is almost lower 3 percentage .

The result of the second note is a little heartbreaking , But the goal is to try , Spare time to play , If you are interested, you can also practice by yourself .

Book donation

Give away books cadastral :3 Ben 《 Explain profound theories in simple language Python Quantitative trading practice 》, from 「 tsinghua university press 」 Sponsorship provides ,Python Quantitative classics , It is strongly recommended to start a book .

Gift rules : Send it out by leaving a message and liking ,「 Forward this article to the circle of friends 」+「 Leaving a message. 」, The number of comments and likes is the largest front 3 position The reader will receive a ( Only when you leave a message can you select ). Opening time :「2 month 25 Japan 20:00」.

matters needing attention : The final recipient is requested to 24 Add my wechat within hours :1072362067, remarks : present sb. with a book , And provide screenshots of circle of friends forwarding and collecting likes . If the machine or non real traffic is found, brush like , After discovery, it will be blacklisted , Disqualification .